U.S. banking regulation is highly fragmented, and is regulated by both the federal and state governments. All commercial banks taking on deposits are obligated to obtain Federal Deposit Insurance Corporation (FDIC) insurance. FDIC provides deposit insurance, which warrants the safety of deposits in member banks, up to $250,000 per depositor per bank since July, 2010. The FDIC also scrutinizes and oversees certain financial institutions for safety and financial soundness, executes certain consumer-protection functions, and administers banks in receiverships, i.e. insolvent banks.

Dodd–Frank Reform inflicts sizable costs

Since the Great Depression, The Dodd–Frank Wall Street Reform and Consumer Protection Act has been the most sweeping transformation to American financial regulation, affecting almost every facet of the nation’s financial services industry. Banks are forced to bear the brunt of higher costs to comply with the law. And that’s during their persistent struggle to control costs while seeking to increase net interest spreads by building their loan portfolios.

Source: Banking sector in the United States

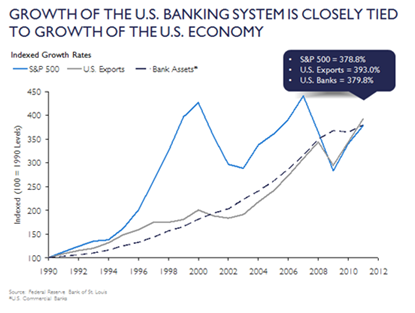

The U.S. banking sector has grown radically over the last five years, whereby the contribution of bank’s portion of assets in the U.S. economy grew from 43% in 2007 to 56% in 2012.

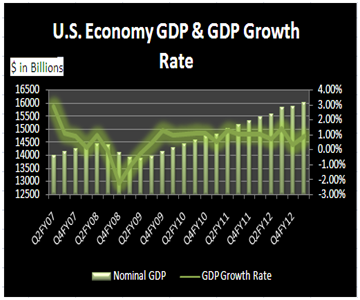

Source = GDP United States

Moody’s recently modified the U.S. banking system outlook to stable, which had been negative since 2008, as the economy’s operating environment continues to recuperate, thereby reducing the downside risks to the banking sector.

GDP growth is projected in the range of 1.5% to 2.5% this year, complemented by an unemployment rate dropping towards 7%. This will help banks protect their balance sheets, and U.S. banks will be well-positioned to face any future economic downturn.

*Source: The Growth of the U.S. Banking System | Financing America’s Economy

As the economy is expected to recover from the recessionary phase, it is likely that the U.S. banking sector will rise as well.

Company analysis

So now that we’ve covered the basics, the goal is to find a great investment. To do this, I narrowed the search to three American banks. Let’s take a look a closer look at First Republic Bank (NYSE:FRC), Wells Fargo & Co (NYSE:WFC) and Bank of America Corp (NYSE:BAC).

Source: Company SEC Filings, Form 10-K

The loan-to-deposit ratio, a bank’s liquidity statistic, stayed slightly above 100% for First Republic Bank (NYSE:FRC) and Bank of America Corp (NYSE:BAC). Both banks are fully utilizing funds at hand, neither under nor over lending. However, Wells Fargo & Co (NYSE:WFC) is playing it safe by lending less than deposits, so as to never fall short of funds.

Non-performing loans (NPLs) are either in default or close to default, with the odds of full recovery being substantially lower. First Republic Bank (NYSE:FRC) has been able to manage its non-performing loans with efficacy with the figure being less than 1% of total loans. However, Wells Fargo & Co (NYSE:WFC) and Bank of America Corp (NYSE:BAC) are lagging behind in risk management. First Republic Bank (NYSE:FRC) has been able to exercise effective risk management ahead of its opponents.