After a rough first-half of 2016, Ron Bobman‘s Capital Returns Management rebounded in a big way during the third-quarter. The finance-focused hedge fund’s long positions in companies valued at $1 billion or more on June 30 delivered weighted average returns of 20.8% in the third-quarter, ranking it as one of the top-20 performing hedge funds in our database for the period.

It should be noted that our calculations may differ from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions. They also don’t include the returns of stakes in equities valued at less than $1 billion, of which Capital Returns had several on June 30. Of its 16 long positions, just seven of them were in companies valued at more than $1 billion.

In this article we’ll take a look at four of those positions and see how they fared during the third-quarter and since.

We’ll start with Assured Guaranty Ltd. (NYSE:AGO), Capital Returns top stock pick on June 30. The fund held 713,280 shares of the stock valued at $18.10 million and representing 10.11% of the value of its public equity portfolio. Assured Guaranty had a solid quarter, returning about 10%, but has actually performed even better in the fourth-quarter, which could bode well for the fund’s returns if it maintained its position. Assured Guaranty Ltd. (NYSE:AGO) jumped by 8% on Friday after it posted results which shattered its numbers from a year earlier. Shares have now gained nearly 15% in the fourth-quarter.

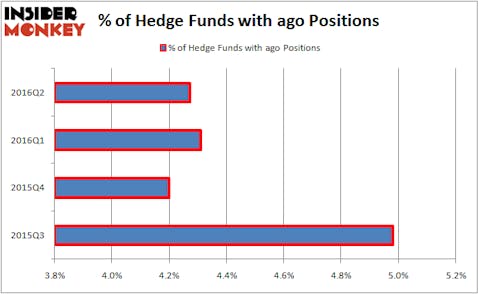

At the end of the second quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in the stock. Sentiment has failed to appreciably improve since sliding during the fourth-quarter of 2015. Those funds that were bullish on June 30 included Fine Capital Partners, managed by Debra Fine ($78.2 million position) and AQR Capital Management, managed by Cliff Asness ($50.9 million position). Some other hedge funds and institutional investors that were bullish on Assured Guaranty Ltd. (NYSE:AGO) encompass Anand Parekh’s Alyeska Investment Group, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ron Gutfleish’s Elm Ridge Capital.

Follow Assured Guaranty Ltd (NYSE:AGO)

Follow Assured Guaranty Ltd (NYSE:AGO)

Receive real-time insider trading and news alerts

Let’s move on to Radian Group Inc (NYSE:RDN), which was Capital Returns’ third favorite stock on June 30. Radian Group was one of the fund’s best performing stocks, gaining 30% during the third-quarter. Despite the quarterly gains, shares are still down by a few percentage points this year. While still well off their pre-financial crisis levels, shares have gained 365% over the past five years.

A total of 31 of the hedge funds tracked by Insider Monkey held long positions in Radian Group Inc (NYSE:RDN) at the end of June, a 7% increase from the end of the previous quarter. Maverick Capital, managed by Lee Ainslie, holds the most valuable position in Radian Group Inc (NYSE:RDN) as of June 30, a $145.3 million position comprising 2% of its 13F portfolio. The second-largest stake is held by Senator Investment Group, led by Doug Silverman and Alexander Klabin, being an $83.4 million position.

Follow Radian Group Inc (NYSE:RDN)

Follow Radian Group Inc (NYSE:RDN)

Receive real-time insider trading and news alerts

We’ll check out two other finance stock picks of Capital Returns on the second page of this article.