Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 37.6% in 2019 (through the end of November) and outperformed the broader market benchmark by 9.9 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

FGL Holdings (NYSE:FG) has seen a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that FG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are many indicators shareholders have at their disposal to size up stocks. A duo of the less known indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can trounce the broader indices by a significant amount (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the new hedge fund action encompassing FGL Holdings (NYSE:FG).

How are hedge funds trading FGL Holdings (NYSE:FG)?

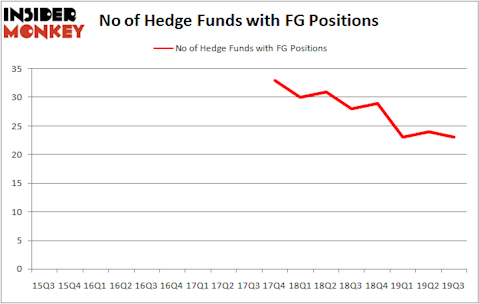

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FG over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Kingstown Capital Management, managed by Michael Blitzer, holds the largest position in FGL Holdings (NYSE:FG). Kingstown Capital Management has a $55.9 million position in the stock, comprising 13.9% of its 13F portfolio. The second largest stake is held by Farhad Nanji and Michael DeMichele of MFN Partners, with a $23.1 million position; the fund has 3.5% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism encompass Brian Gootzeit and Andrew Frank’s StackLine Partners, Joshua Nash’s Ulysses Management and Richard Driehaus’s Driehaus Capital. In terms of the portfolio weights assigned to each position Kingstown Capital Management allocated the biggest weight to FGL Holdings (NYSE:FG), around 13.86% of its 13F portfolio. StackLine Partners is also relatively very bullish on the stock, dishing out 10.43 percent of its 13F equity portfolio to FG.

Seeing as FGL Holdings (NYSE:FG) has experienced declining sentiment from hedge fund managers, it’s easy to see that there was a specific group of hedge funds that decided to sell off their positions entirely by the end of the third quarter. Interestingly, Marc Majzner’s Clearline Capital cut the largest investment of the 750 funds watched by Insider Monkey, worth close to $5.3 million in stock, and Brandon Haley’s Holocene Advisors was right behind this move, as the fund cut about $0.3 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as FGL Holdings (NYSE:FG) but similarly valued. We will take a look at Patterson-UTI Energy, Inc. (NASDAQ:PTEN), Walker & Dunlop Inc. (NYSE:WD), Installed Building Products Inc (NYSE:IBP), and Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH). This group of stocks’ market caps resemble FG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PTEN | 26 | 251357 | 1 |

| WD | 15 | 72221 | 0 |

| IBP | 20 | 189032 | 7 |

| DCPH | 26 | 542998 | 11 |

| Average | 21.75 | 263902 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $176 million in FG’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand Walker & Dunlop Inc. (NYSE:WD) is the least popular one with only 15 bullish hedge fund positions. FGL Holdings (NYSE:FG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on FG as the stock returned 14.5% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.