The value trap is the tendency of a value approach to buy a decelerating company. The value trap has been a major problem for value investors over the past two decades. The most obvious value trap is the cyclical stock at cycle peak. Because the cash flow acceleration has been very strong throughout the cyclical acceleration, the dividend tends to increase at a more rapid rate than the share price, producing a high yield buy decision. With the recent share price declines the Price to Earnings Ratio (PE) has also become very misleading and no longer justly reflects how much investors are willing to pay. Before you buy, look for solid fundamentals and continued growth potential. Such as:

gzaleckas/Shutterstock.com

Q1 2020 hedge fund letters, conferences and more

Federal Signal Corporation $26.080 BUY this poor company getting better

*Not investment advice

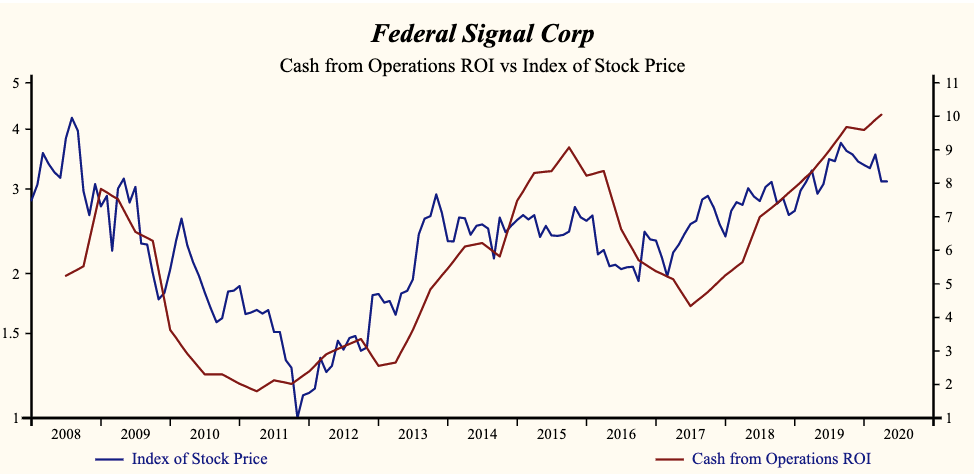

Federal Signal Corporation (NYSE:FSS) has been an unprofitable company with chronically low cash return on total capital of 6.6% on average over the past 21 years. Over the long term the share price has advanced by 61% relative to the broad market index.

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 84% correlated with the share price.

Currently, sales growth is 10.8% which is high in the record of the company but slightly lower than last quarter. Higher sales growth has been 60% correlated with the share price with a five-quarter lead. Receivables turnover continues to decline which has been 80% correlated with the direction of the share price with a four-quarter lead. Falling receivables tends to indicate an increase in the quality of sales growth by avoiding to finance their own sales.

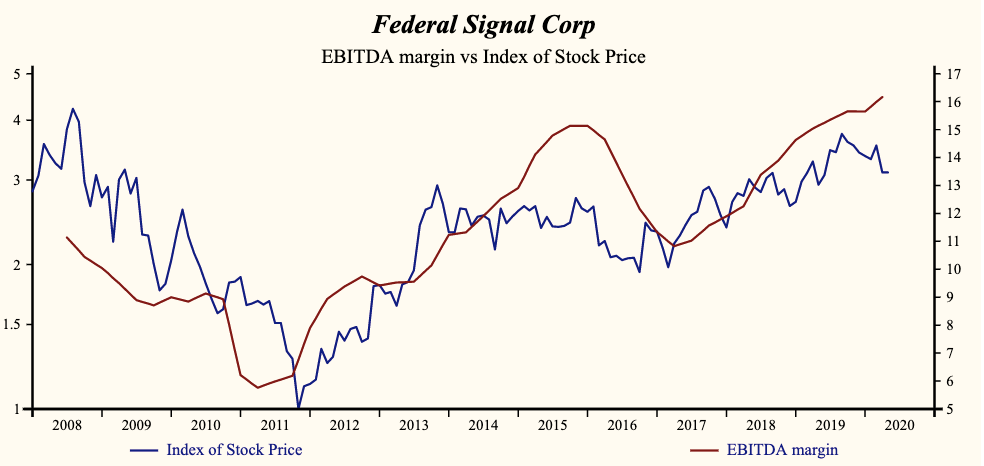

The shares have been highly correlated with the direction of the margins and the quality of the balance sheet. Federal Signal has a high and rising gross margin. Inventories are down, improving the chance of a further increase in the gross margin. SG&A expenses are low in the record and falling. Lower SGA costs to sales has been 75% correlated with the direction of the share price with a one-quarter lead. That implies that the company can further reduce costs but at the expense of slowing EBITDA growth rate relative to sales. Interest costs also continues to fall accelerating cash flow growth which is often associated with lower valuation. Since interest costs and SG&A expenses are mostly fixed costs, they act as leverage between the primary growth drivers and cash flow.

More recently, the shares of Federal Signal Corp have advanced by 15% since the December, 2018 low. The current indicated annual dividend produces a yield of 1.2%, a trailing twelve-month PE ratio is 14.5 and five-year average dividend growth stands at 6.8%. Current trailing operating cash-flow coverage of the dividend is 8.8 times.

The shares are trading at lower-end of the volatility range in a 16-month rising relative share price trend. The current depressed share price provides a good opportunity to buy the shares of this accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Disclosure: None