More margin pressure

In common with Dollar General Corp. (NYSE:DG), Family Dollar Stores, Inc. (NYSE:FDO) is seeing margin pressure as its sales mix shifts towards lower-margin consumables and away from higher-margin discretionary items. In fact, the share of consumables rose to 72.5% of total sales, compared to 68.9% last year. In contrast, Dollar Tree, Inc. (NASDAQ:DLTR) managed to benefit from margin expansion by growing its sales mix in the other direction. However, this appears to be an isolated case amongst the mass market retailers.

Family Dollar actually highlighted industry data that suggested that its typical consumer was spending less in the marketplace, but more at its stores. This is not a great sign for the economy. This data also implies that if there is growth to be generated, it will come at the expense of its competition. Family Dollar Stores, Inc. (NYSE:FDO) is likely taking share from the supermarkets within the grocery category. Unfortunately, consumables like tobacco and groceries are not really high-margin items. So even as Family Dollar expands sales in these areas, it will not see gross margin expansion.

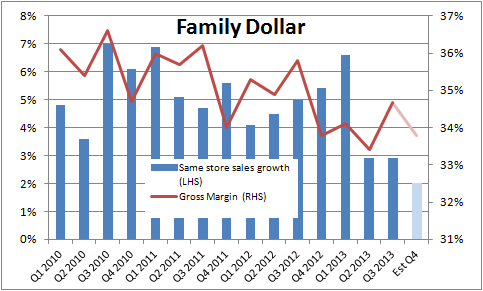

These trends are nicely illustrated with a look at the company’s sales and margin trends over the last few years. Note the company’s forecast for the next quarter is for an anemic-looking 2% same store sales growth. This is a bit disappointing, because even though the first quarter was weak for most retailers due to a number of issues (payroll tax increases, tough weather comps, tax refund delays and the sequester), the second quarter was supposed to be a more favorable environment.

On the other hand, the positive news is that gross margins were forecast to be almost flat in the next quarter, much to the liking of the markets.

Why the market likes these results

The real takeaway of these results is how Family Dollar Stores, Inc. (NYSE:FDO) is adjusting to a slower sales environment. Gross margins were predicted to be almost flat in the fourth quarter, and in the conference call, the management discussed the possibility for them to be flat in 2014 as well. There are a number of reasons for a more positive outlook for both gross and operating margins:

- The company has adjusted to the slower sales environment and is now highly focused on reducing things like freight, distribution center, and advertising costs.

- It is starting to lap the unfavorable mix shift movements from last year, so comparisons will get easier.

- Management spoke of some recent improvements in its core discretionary businesses and spoke of the beginnings of stabilization.

The last point is the key, because Dollar Tree, Inc. (NASDAQ:DLTR) has already managed to do this in 2013, while Dollar General Corp. (NYSE:DG) was punished by the market in early June when it lowered guidance thanks to weakness in its discretionary sales. In addition, Family Dollar is somewhat playing catch-up because its discretionary merchandising decisions were below par in 2012. In short, Family Dollar Stores, Inc. (NYSE:FDO)tried to increase sales with discretionary items like clothing, but found it a tough sell to its customers.

Why you shouldn’t get too excited

In putting these points together, it’s hard not to be puzzled as to why the market dragged the other two dollar stores up in sympathy. Family Dollar didn’t have many good things to say about the economy. In addition, if it really is winning market share, then the other dollar stores could be missing out.

Also, the dollar stores have tended to report similar trends in same store sales (as shown in the graph below), but they have tended to differ in how they deal with sales mix issues and getting their discretionary sales right.

In conclusion, if these results were all about Family Dollar Stores, Inc. (NYSE:FDO) adjusting to a slower sales environment, then there isn’t a strong reason to think that Dollar Tree, Inc. (NASDAQ:DLTR) and Dollar General Corp. (NYSE:DG) are about to shoot the lights out in their next reports. Don’t get too excited.

Lee Samaha has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Don’t Get Too Excited by the Prospects for the Dollar Stores originally appeared on Fool.com.

Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.