The shift toward mobile is everywhere. In just the past 5 years, smartphone and tablet adoption has skyrocketed, pushing users to smaller screens and away from .exe files to Android and iOS applications.

Investors are still trying to figure out exactly how much money there is in mobile. Judging from Facebook Inc (NASDAQ:FB)‘s first quarter 2013 earnings call, that answer seems to be “not that much.”

Facebook’s latest quarter

Facebook’s key metrics came in largely better than expected. In particular, the social media company posted:

More activity per user – Users are divided into daily and monthly active users. In the first quarter, 60% of monthly active users were also daily active users, up from 59% in the prior quarter, and 58% in the first quarter of 2012, suggesting more “stickiness” to the social media platform.

Surging mobile use – Mobile active monthly users rose from 680 million users in the fourth quarter of 2012 to 751 million users in the first quarter of 2013. This bodes well for Facebook’s operating leverage and the potential to get more screen views – on desktops and mobile devices – from its installed base.

Rising revenue – Facebook Inc (NASDAQ:FB) recorded $1.46 billion in revenue in the first quarter, up from $1.06 billion in the year ago period, representing growth of 37.7% against a much more tepid increase in total users of 22%. The company sees revenue growth from better targeted advertising placements and more of them. Facebook first disclosed its mobile revenue in the third quarter of 2012, when it reported a paltry $146 million in mobile advertising sales. In the latest quarter, revenue grew 23% from the previous quarter to $375 million.

Investors took favorably to Facebook Inc (NASDAQ:FB)’s impressive revenue growth and transition to mobile. Concerns over whether or not Facebook could and would grow its mobile app and website into a profitable product weighed on the company for much of the summer and fall of 2012. Top line growth appeased most analysts.

Despite all the growth that investors see, justifying its current valuation isn’t as easy as 1-2-3.

What’s wrong with Facebook

For all the promise of social networking and mobile advertising, Facebook fails to deliver on the bottom line. The company reported growth, but growth came at a price – diluted EPS was flat from the year-ago period at $0.09 per share. Nine cents does not go far in justifying a share price upwards of $28.

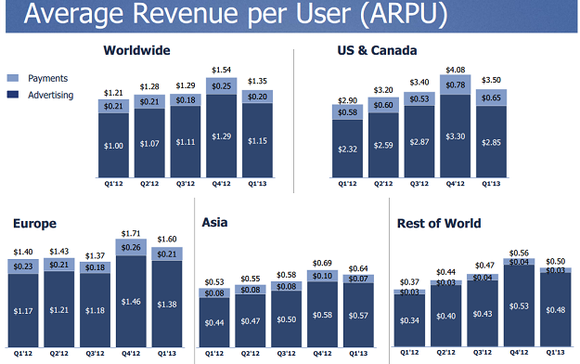

Facebook Inc (NASDAQ:FB) lacks growth in markets which offer the best average revenue per user (ARPU). Here’s a chart of daily active users from the earnings call slides:

Notice how the fastest growing areas, Asia and “Rest of World” are also the areas where Facebook derives very little revenue per user:

Investors quickly pass over this key information, claiming that Facebook Inc (NASDAQ:FB) has potential to grow average revenue per user in emerging markets as consumer economies develop. Economies develop at a snail’s space compared to the internet, however, and making more money from the same number of users isn’t as easy as flipping a switch.

Future growth against growing competition

Few companies survive longer than a few years online. Friendster was crushed by News Corp (NASDAQ:NWSA)’s Myspace, Myspace was ruined by the emergence of Facebook.

There are several weaknesses in the Facebook model that will play out long before emerging markets match ARPUs of developed markets:

Commoditized data – Facebook has an extraordinary amount of data on its active user base. However, Google Inc (NASDAQ:GOOG), Amazon.com, Inc. (NASDAQ:AMZN) , and Twitter also harvest data on their users. Social sharing tools collect just as much data for Twitter and Google Inc (NASDAQ:GOOG) as they do Facebook Inc (NASDAQ:FB). Meanwhile, Amazon.com, Inc. (NASDAQ:AMZN) learns not only where people go on the web, but also exactly what they buy, what influences consumers to make an online purchase, and what each customer is most interested in purchasing. After all, investors should not forget that advertising is valuable insofar as it can influence purchasing decisions. Investors seem all too eager to accept growing advertising revenue per user without the simple consideration that Twitter, Google Inc (NASDAQ:GOOG) and Amazon.com, Inc. (NASDAQ:AMZN) can perhaps provide just as much quality data at a lower price through a more compelling medium.

Weakening moat – Google Inc (NASDAQ:GOOG) has effective monopoly power in online search, and the company enjoys a huge head start on the competition. The search engine giant has not sat idle, instead using that time to refine and perfect its algorithms before competitors even thought about entering the market. Google Inc (NASDAQ:GOOG)’s search is the central station of the internet – the way to get to where you want to go. A Yellow Pages that is enormously profitable, extremely useful, and inexpensive to maintain. Facebook is a destination at which visitors end their online hunts, and where few purchases are ever made.

Niche competition – Facebook’s $1 billion acquisition of Instagram signaled that the company was now on the defensive. Pictures, not status updates or “likes,” are the social network’s bread and butter. New competition in the space continuously threatens Facebook’s competitive advantage in picture content for nosy heavy users. New apps like SnapChat and WhatsApp have added millions of users interested in features that are central to Facebook’s dominance – pictures and free messaging between friends. The message is making its way through the grapevine; Facebook is losing its “cool factor” with teens and 20-somethings.

New devices – Google Glasses may be a far-off consumer product, or just another prototype better suited for science fiction than modern reality, but they represent a real risk in that if the platform changes, Facebook is at risk. Google Inc (NASDAQ:GOOG) Glasses will be seamlessly integrated with the company’s lagging social network, Google+, invigorating it with more video and picture content from launch day. This risk, though slight, would completely change the game for Facebook’s social media position.

The bottom line

At $28 per share, Facebook appears tremendously overvalued. Removing the company’s $9.5 billion in cash and marketable securities ($3.80 per diluted share) gives a valuation of $24.20 based on nothing more than 9 cents in GAAP quarterly earnings. The company’s best year was in 2010, when it earned $0.43 per diluted share. Since then, the company has posted two lackluster years of a single penny in diluted GAAP EPS.

Given growing competition, little-to-no margin expansion from mobile advertising, and a cost structure that seemingly implies there are few economies of scale at the existing cost base, Facebook is a high-priced stock just waiting for correction. Like Apple Inc. (NASDAQ:AAPL), that correction will come when the top line music stops and investors are left cheering on slowing sales with minute margin expansion. The only people benefiting from this gravy train of a momentum stock are the insiders who receive stock option compensation conveniently ignored in non-GAAP accounting Facebook executives push onto analysts.

Facebook is a lottery ticket at best, a business that cannot be justified as anything beyond a lottery ticket for a future that can be seen only through rose-colored glasses.

The article Mobile Ads: Good but Certainly Not Great originally appeared on Fool.com is written by Jordan Wathen.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.