Charitable giving is an important part of American society, and many corporate leaders, who’ve earned their wealth through the stock market or other investments, have gone on to become some of the most generous individuals in the world. Given the concentration of wealth that most of these donors have in a single stock, however, their capacity to give can change markedly from year to year.

With that in mind, let’s take a look at the five most generous donors of last year according to the Chronicle of Philanthropy. By looking not only at how much they gave in 2012, but also how the companies they’re affiliated with have performed so far this year, we should be able to tell whether they’ll be in a position to make even more generous gifts in 2013 and beyond.

| Donor | Company/Source of Wealth | Amount Given or Pledged in 2012 |

|---|---|---|

| Warren Buffett | Berkshire Hathaway | $3.1 billion |

| Mark Zuckerberg & Priscilla Chan | Facebook (NASDAQ:FB) | $498.8 million |

| John & Laura Arnold | Centaurus Energy hedge fund | $423.4 million |

| Paul Allen | Microsoft (NASDAQ:MSFT) | $309.1 million |

| Sergey Brin & Anne Wojcicki | Google (NASDAQ:GOOG) | $222.9 million |

Source: Chronicle of Philanthropy.

These donors have all earned reputations for their philanthropic efforts, with most of them having a long history of donations. Warren Buffett has been making regular donations of Berkshire stock to the Gates Foundation, founded by Microsoft Corporation (NASDAQ:MSFT) co-founder Bill Gates, for years. Paul Allen, Microsoft Corporation (NASDAQ:MSFT)’s other co-founder, made the bulk of his donations last year toward advancing brain research, with the goal of solving the mysteries of Alzheimer’s and other neurological conditions. Sergey Brin, co-founder of Google Inc (NASDAQ:GOOG), has been giving substantial sums toward research into Parkinson’s disease for years, with a family history of the disease making the cause hit close to home for Brin. And for John Arnold, who worked as a trader for Enron before going out on his own to start a hedge fund, the foundation he and his wife established aims at improvements in a number of key areas, including the criminal justice, education, and pension systems.

Berkshire Hathaway CEO Warren Buffett with President Barack Obama. Source: White House.

Meanwhile, Mark Zuckerberg’s wealth is more recent, but he upped the ante last year after a $100 million gift to the Newark, N.J. public school system in 2010. Zuckerberg and his wife committed nearly half a billion dollars last year toward a foundation aimed at health and educational efforts.

Can they give more?

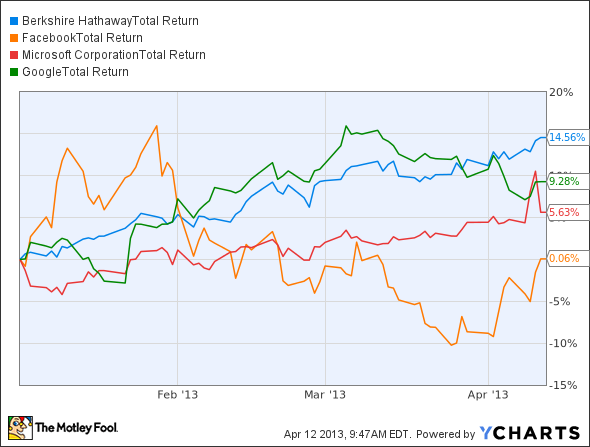

Thanks to recent gains in the stock market, most of the public companies tied to these donors’ fortunes have done fairly well:

Total Return Price data by YCharts.

Berkshire has seen the best return of the four stocks, as its core insurance business has produced good results, and its portfolio of well-known stocks and wholly owned subsidiaries have also performed well. Google’s stock has continued its long bull-market run higher, with investors expecting troubling past trends in ad-related revenue to reverse and start contributing more strongly to its overall growth. Even Microsoft has managed to make progress in its share price lately, despite all the negative press about its attempts to crack into the mobile market. And even though Facebook Inc (NASDAQ:FB) hasn’t delivered the returns that IPO investors would have wanted, the stock has nevertheless stabilized, and future prospects for growth seem to be on the rise as Facebook searches out ways to monetize its billion-member social network.

Look for more donations

Rising share prices are no guarantee that these donors will be more generous in the future. But given their past giving histories, it’s fair to expect that they’ll find ways to make even more meaningful gifts both in 2013, and beyond.

The article Why 2012’s Top Charitable Donors Should Give Even More This Year originally appeared on Fool.com.

Fool contributor Dan Caplinger owns shares of Berkshire Hathaway. You can follow him on Twitter @DanCaplinger. The Motley Fool recommends Berkshire Hathaway, Facebook, and Google. The Motley Fool owns shares of Berkshire Hathaway, Facebook, Google, and Microsoft.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.