Unless you are a trader that measures holding periods in days, the short answer is nothing. The S&P 500 has raced out of the gate to start 2013 and is within a stone’s throw of its all-time high. The bears continue to be proven wrong, but still find their way into popular media outlets to scare everyone. Even the bulls are attempting to “guess” when the next pullback will be given that sentiment has reached excessive exuberance. This is all noise for investors that aren’t looking to flip their entire portfolio in a year, but instead make investment allocation based on cyclical dynamics that can last anywhere from 18 months to several years. To these investors, the prudent course is to continue to maintain a maximum equity allocation as the great rotation out of bonds and into stocks approaches. Equities remain extremely cheap in the context of 1.7% inflation. Will there be a pullback? ABSOLUTELY. This is how the markets work. It can happen at any moment, but looking out 6 months, 12 months, or 18 months it is becoming increasingly likely that equities will be at new highs. Below are several reasons to maintain a bullish tilt to your portfolio.

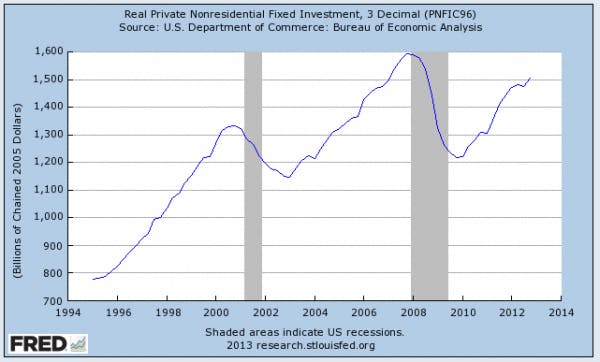

Sure GDP contracted by 0.1%, but that was because government defense outlays declined at their fastest rate since 1972. This appears to be the smaller government that a certain party has been begging for and it came from the industry that the other party demanded. We should all rejoice, right? I don’t believe this drop in defense spending is good, but that is a different argument. The main highlight to the GDP report was the underlying strength everywhere else. Consumer spending was strong, investment was strong, and housing was exceptional. Real private nonresidential fixed investment, a proxy for capex surged 8.4% in the fourth quarter. Anyone looking at the chart below should find solace in the direction of capital spending and what it means for the economy.

This supports the continued notion that technology companies such as F5 Networks, Inc. (NASDAQ:FFIV) will continue to grow as corporations seek out their application software. F5 Networks is the leading vendor in the application delivery market that provides companies data center flexibility at a fraction of the cost of building out a massive in-house IT department. The company reported earnings last week and CEO John McAdam echoed a similar tone to the recent GDP report.

“During the first quarter, strong sales to North American enterprises and service providers were offset by a substantial slowdown in U.S. Federal sales”

Sentiment is Way Too High

TRUE. Investor sentiment is way too high and will have to revert to the mean via a sideways market or a pullback of some sort. But this pullback may only be 3%, or 5%, and then it could be off to new highs quickly thereafter. The chart below shows the American Association of Individual Investors’ confidence and it is at two-year highs. Notice the peaks since 2009. There are at least 6 really high readings in the last three years. Where is the market now? At new highs! Do you think you could have timed all six of those perfectly? Got out and in at the exact right moment? The bottom line is that sentiment is a worthless indicator for market peaks, but is good at identifying great buying opportunities.