What is the future of technology, energy, and the economy? Investors who know the answers to these three questions can profit handsomely. After all, every investment is made under the assumption that something tangible will happen in the future. Because of this, we can’t help but want to guess, and make an intelligent one at that.

Energy

I think that energy is one of the most important commodities in the market. Without energy, an economy simply cannot function. Many are wondering where we will find dependable sources of energy, and what peak-oil really means. Does that mean we will not be able to drive our cars on a Sunday afternoon? Does it mean that prices will become so prohibitive that the economy will crash? There are all sorts of theories.

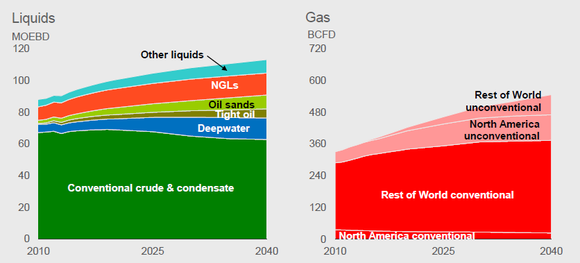

Source: Exxon Mobil (NYSE:XOM)

Exxon Mobil Corporation (NYSE:XOM) projects that conventional crude oil production will decline from 2010 onwards. Crude oil will have to be extracted from unconventional sources like deep water drilling, and oil sands. Natural gas liquids will become an increasingly larger source of energy as well as other liquids like biomass (algal biofuels). This will have a negative impact on oil companies. Alternative sources of energy cost more to produce, thus lowering gross margins. The added cost of production should keep investors mindful of future changes in the energy mix. Also, demand for crude oil may eventually taper as consumers shift to hybrid and electric vehicles.

Cost effective electric vehicles from GM, Ford, and Tesla Motors Inc (NASDAQ:TSLA) will be hitting the market soon. The CEO of Tesla Motors Inc (NASDAQ:TSLA) believes that it can release an electric vehicle in the $30,000 price range over the next three to five years. Given the time frame mentioned, the fuel-mix projections over the next 20 years are likely to be wrong because the upstream market for energy on the utility side of the market is much different from the one for automobiles.

The differences come from the fact that oil refiners can use varying sources of material to refine into typical gasoline (the selection is primarily crude oil, natural gas, and biomass). However, with electric utilities, and battery technology, a much broader mix of energy can be accepted for use (nuclear, coal, solar, hydro, and so on).

Source: EIA

The projections indicate that demand for renewables will grow exponentially.

Solar will power the future

Source: Citi Research

The average cost per watt of a solar panel may fall to $0.25 by 2020. The research is based on a variation of Moore’s law, which the Citigroup team calls “single speed.” The idea is that the price of solar panels will fall by 22 cents every time installed capacity doubles. The basic idea is that the cost of solar is expected to be cheaper than both natural gas and coal fire power plants by 2020. This also means that solar will become cheaper than crude oil.

Investors will profit from investing into solar panels. Winners in this shift to alternative energies will be companies like First Solar, Inc. (NASDAQ:FSLR) . Losers in this shift will be companies like CONSOL Energy.

What to expect

Analysts on a consensus basis anticipate the solar industry to grow earnings by 9.48% in fiscal year 2013. In comparison, Exxon Mobil Corporation (NYSE:XOM) missed analyst expectations by 18.4% in the second quarter. The miss on earnings came as a result of falling oil demand.

Exxon Mobil Corporation (NYSE:XOM) may have to depend on its natural gas business, but with solar costs drastically falling, maybe the upstream market for dirty-energy will become technologically obsolete. The scale of solar installation may improve beyond our current expectations, and could be a larger component of the energy mix depending on production and efficiency gains. The demand for clean energy is very real as it’s becoming clear as day that pollution is a key threat to long-term prosperity.

Cloud

International Business Machines Corp. (NYSE:IBM) beat earnings this past quarter by 3.70%. The company’s business is starting to stabilize because it’s shifting its focus away from hardware and into software and services.

International Business Machines Corp. (NYSE:IBM) believes that the future of decision making is going to be about big-data. Big-data is the process of accumulating large amounts of data, and being able to find patterns in the data that may lead to better decision making.

When people think of the cloud, there are many ideas on what the cloud is. But one of the biggest trends in the cloud today is the software-as-a-service side of the market. Many of you are probably already familiar with it. But it’s basically web based programs that can be purchased through a subscription.

Anything that can potentially be automated will be. Anything that can be analyzed will be. In order to analyze, you need data, and in order to automate you need computers. The two go hand in hand. Execution through automation and decision making due to having better sources of data will lead to higher rates of profitability.

Eventually, more advanced artificial intelligence will hit the market. The idea of androids walking around is leery at best. Programming language is becoming better and will become more fine-tuned to follow human logic and reasoning skills. The idea of web 3.0 (semantic web) is to allow programming logic (computer logic) to better interpret and understand human logic. The idea is that human logic is more complex than programming logic, and to make programs more adaptable to the environment is key in making sure computers are able to follow human requests. If humans can request a robot to do more complex commands, the future potential for non-human labor may be near limitless.

Conclusion

Investors should be investing heavily into alternative energies and the cloud. The future potential of big data should not be underestimated. The cloud will continue to grow, and the use of artificial intelligence will become more common.

The aggregate production possibilities frontier (economic output based on opportunity cost) will expand further to the right. I am willing to assume that the supply side of the economy will continue to improve due to improvements in energy and automation.

Alexander Cho has no position in any stocks mentioned. The Motley Fool recommends Tesla Motors . The Motley Fool owns shares of International Business Machines (NYSE:IBM). and Tesla Motors.

The article Investing in the Next Ten Years of Technology and Energy originally appeared on Fool.com and is written by Alexander Cho.

Alexander is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.