Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th. In this article, we are going to take a look at smart money sentiment towards Exxon Mobil Corporation (NYSE:XOM).

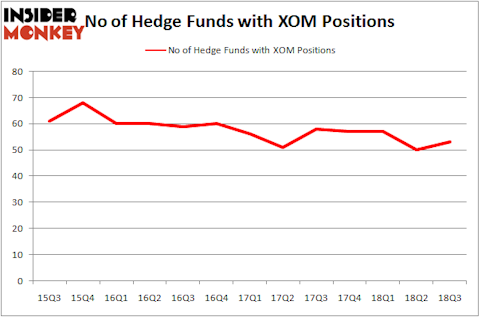

Exxon Mobil Corporation (NYSE:XOM) was in 53 hedge funds’ portfolios at the end of September. XOM investors should be aware of an increase in support from the world’s most elite money managers of late. There were 50 hedge funds in our database with XOM holdings at the end of the previous quarter. Our calculations also showed that XOM isn’t among the 30 most popular stocks among hedge funds, but is one of the 25 Best Dividend Stocks for Retirement.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

What have hedge funds been doing with Exxon Mobil Corporation (NYSE: XOM)?

At Q3’s end, a total of 53 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards XOM over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Exxon Mobil Corporation (NYSE:XOM), with a stake worth $497.8 million reported as of the end of September. Trailing Fisher Asset Management was Pzena Investment Management, which amassed a stake valued at $396 million. AQR Capital Management, Adage Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, established the most outsized position in Exxon Mobil Corporation (NYSE:XOM). Renaissance Technologies had $70.1 million invested in the company at the end of the quarter. Vince Maddi and Shawn Brennan’s SIR Capital Management also made a $22.3 million investment in the stock during the quarter. The following funds were also among the new XOM investors: Ian Cumming and Joseph Steinberg’s Leucadia National, Louis Bacon’s Moore Global Investments, and Jeffrey Talpins’s Element Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Exxon Mobil Corporation (NYSE:XOM) but similarly valued. These stocks are Visa Inc (NYSE:V), Royal Dutch Shell plc (NYSE:RDS), Bank of America Corporation (NYSE:BAC), and Walmart Inc. (NYSE:WMT). This group of stocks’ market caps resembles XOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| V | 112 | 14434960 | 3 |

| RDS | 36 | 2483228 | -3 |

| BAC | 102 | 32047570 | -7 |

| WMT | 60 | 4719208 | 8 |

| Average | 77.5 | 13421242 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 77.5 hedge funds with bullish positions and the average amount invested in these stocks was $13.42 billion. That figure was $2.08 billion in XOM’s case. Visa Inc (NYSE:V) is the most popular stock in this table. On the other hand, Royal Dutch Shell plc (NYSE:RDS) is the least popular one with only 36 bullish hedge fund positions. Exxon Mobil Corporation (NYSE:XOM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, V might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.