First-quarter earnings are pouring in, and there are plenty of lessons to be learned from this quarter’s results. Let’s look at a few reports, identify common trends, and decide whether dividend stocks will soar or stumble in the quarters ahead.

Did Exelon Corporation (NYSE:EXC) excel?

Exelon reported earnings Thursday, beating both top- and bottom-line expectations. Even with major gains across the board, a cursory look at Exelon’s earnings left investors wanting more. Merger synergies didn’t meet their expected mark, and misjudged hedges pushed the company to take a $235 million one-time hit. But its hedged position also hints at profit potential in the months ahead. As natural gas prices head higher, the nuclear-centric utility is poised for increasing cost competitiveness. The dividend stock is up 18% over the last quarter, and favorable energy prices could present the utility with even more upside in the months ahead.

TECO takes a tumble

TECO Energy, Inc. (NYSE:TE) sent Mr. Market mixed messages with overwhelming earnings but underwhelming sales. At first glance, TECO’s future is synonymous with coal. Its regulated Tampa Electric relies on coal for 61% of its generation, and it even owns and operates Appalachian coal mines capable of producing 9 million tons of solid black gold annually.

Duke makes the most of its merger

Duke Energy Corp (NYSE:DUK) reported earnings Friday, surpassing sales expectations but bottoming out on bottom-line earnings. The utility took major hits within its coal and gas commercial generation businesses, but it managed to make up for losses with strong earnings on its regulated front.

Investors were watching this quarter’s results especially closely for signs of synergies from the utility’s July 2012 Progress Energy merger. Q1 sales signal that the partnership has proved effective, and Duke Energy Corp (NYSE:DUK)’s merger moves remain on track from an operational standpoint.

The company isn’t immune from natural gas price spikes, but its diversity will help offset any gas losses with gains from its nuclear, coal, and renewable assets. Some other utilities might not fare as well. While Duke Energy Corp (NYSE:DUK) relies on natural gas and oil for 37% of its capacity, Atlantic Power Corp (NYSE:AT) has dug into its gas gamble with 58% capacity and plans to invest more in the coming quarters.

Dividend stocks for the win?

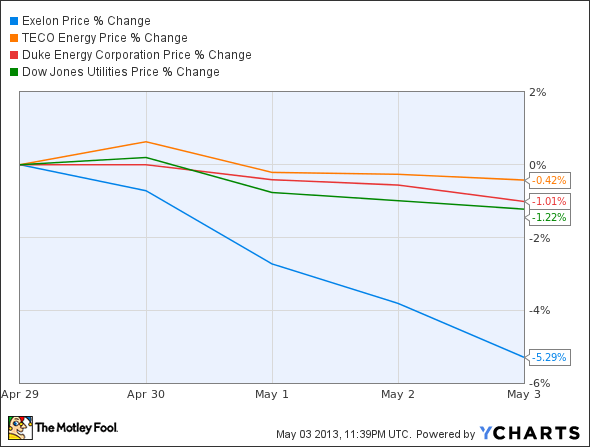

Over the past week, utility stocks have stumbled, although Duke Energy Corp (NYSE:DUK) and TECO Energy, Inc. (NYSE:TE) remain above the industry’s average return rate.

But 2013 has proved profitable for these dividend stocks. Exelon Corporation (NYSE:EXC) is up 20.3%, while TECO Energy, Inc. (NYSE:TE)’s relative lag still leaves it with 13% gains.

Looking ahead, investors will need to keep a close watch on each utility’s regulatory wins and losses, as well as its energy portfolio offerings. Although recent spikes in natural gas may present potentially lucrative value grabs, they should also serve as a reminder that the best investments provide sustainable profits through thick and thin. Long-term investors will choose diversified dividend stocks that keep sales soaring and margins maximized for the next quarter, the next year, and beyond.

The article Utilities Earnings Recap: Did These Dividend Stocks Deliver? originally appeared on Fool.com.

Motley Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends Exelon.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.