It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Evercore Partners Inc. (NYSE:EVR).

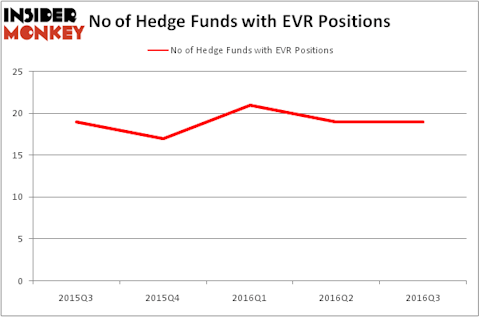

Evercore Partners Inc. (NYSE:EVR) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare EVR to other stocks including Enbridge Energy Management, L.L.C. (NYSE:EEQ), Colony Financial Inc (NYSE:CLNY), and Great Western Bancorp Inc (NYSE:GWB) to get a better sense of its popularity.

Follow Evercore Inc. (NYSE:EVR)

Follow Evercore Inc. (NYSE:EVR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

How have hedgies been trading Evercore Partners Inc. (NYSE:EVR)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. Hedgie ownership of EVR has remained in a narrow range throughout the last year, of between 17 and 21 hedge funds. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies has the largest position in Evercore Partners Inc. (NYSE:EVR), worth close to $60.4 million. The second largest stake is held by James Parsons of Junto Capital Management, with a $44.1 million position; the fund has 5.8% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Mariko Gordon’s Daruma Asset Management, Ken Griffin’s Citadel Investment Group and Glenn Russell Dubin’s Highbridge Capital Management.

Due to the fact that Evercore Partners Inc. (NYSE:EVR) has experienced flat interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few money managers that decided to sell off their full holdings by the end of the third quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management sold off the biggest stake of the “upper crust” of funds tracked by Insider Monkey, worth close to $2.5 million in stock, and Matthew A. Weatherbie’s Weatherbie Capital was right behind this move, as the fund dumped about $1.9 million worth of shares. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Evercore Partners Inc. (NYSE:EVR) but similarly valued. These stocks are Enbridge Energy Management, L.L.C. (NYSE:EEQ), Colony Financial Inc (NYSE:CLNY), Great Western Bancorp Inc (NYSE:GWB), and Talen Energy Corp (NYSE:TLN). All of these stocks’ market caps are similar to EVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EEQ | 6 | 23910 | 1 |

| CLNY | 25 | 320571 | -2 |

| GWB | 11 | 43827 | -1 |

| TLN | 20 | 193758 | -4 |

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $146 million. That figure was $198 million in EVR’s case. Colony Financial Inc (NYSE:CLNY) is the most popular stock in this table. On the other hand Enbridge Energy Management, L.L.C. (NYSE:EEQ) is the least popular one with only 6 bullish hedge fund positions. Evercore Partners Inc. (NYSE:EVR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CLNY might be a better candidate to consider a long position.

Disclosure: None