It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 30 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 15.1% over the last 12 months (vs. 5.6% gain for SPY), with 53% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Essex Property Trust Inc (NYSE:ESS).

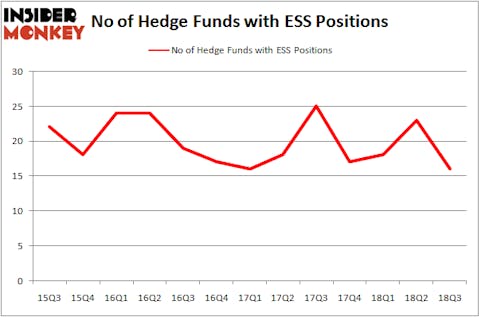

Essex Property Trust Inc (NYSE:ESS) was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. ESS has experienced a decrease in support from the world’s most elite money managers of late. There were 23 hedge funds in our database with ESS holdings at the end of the previous quarter. Our calculations also showed that ESS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the recent hedge fund action surrounding Essex Property Trust Inc (NYSE:ESS).

What does the smart money think about Essex Property Trust Inc (NYSE:ESS)?

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of -30% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in ESS heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jim Simons’s Renaissance Technologies has the largest position in Essex Property Trust Inc (NYSE:ESS), worth close to $161.3 million, accounting for 0.2% of its total 13F portfolio. Coming in second is Israel Englander of Millennium Management, with a $84.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism contain Jeffrey Furber’s AEW Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Dmitry Balyasny’s Balyasny Asset Management.

Seeing as Essex Property Trust Inc (NYSE:ESS) has witnessed falling interest from the smart money, it’s safe to say that there is a sect of hedge funds that decided to sell off their entire stakes in the third quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the largest investment of the 700 funds tracked by Insider Monkey, valued at an estimated $12.9 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also sold off its stock, about $11.3 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 7 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Essex Property Trust Inc (NYSE:ESS) but similarly valued. We will take a look at CNH Industrial NV (NYSE:CNHI), Weibo Corp (NASDAQ:WB), Nomura Holdings, Inc. (NYSE:NMR), and Skyworks Solutions Inc (NASDAQ:SWKS). This group of stocks’ market caps are similar to ESS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNHI | 14 | 341616 | 0 |

| WB | 23 | 289445 | 3 |

| NMR | 2 | 38756 | -2 |

| SWKS | 25 | 1037653 | -2 |

| Average | 16 | 426868 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $427 million. That figure was $407 million in ESS’s case. Skyworks Solutions Inc (NASDAQ:SWKS) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 2 bullish hedge fund positions. Essex Property Trust Inc (NYSE:ESS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SWKS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.