We came across a bullish thesis on Entegris, Inc. (NASDAQ:ENTG) on ValueInvestorsClub by madler934. In this article, we will summarize the bulls’ thesis on ENTG. The company’s shares were trading at $107.30 when this thesis was published, vs. the closing price of $103.52 on Feb 26.

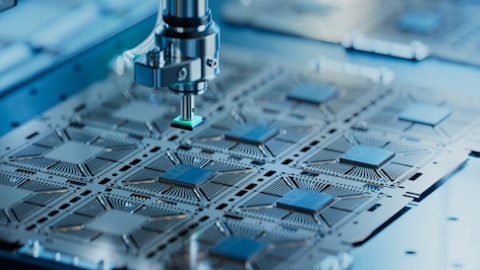

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

ENTG through its Materials Solutions (MS) and Advanced Purity Solutions (APS) segments provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia. MS offers materials-based solutions and accounts for 42% of its revenue while the remaining 58% comes from the APS segment that provides filtration, purification, and contamination-control solutions to the semiconductor industry.

Even though the AI revolution has created demand for wafers, businesses from auto and industrial companies have muted. There is a 20% reduction in production volume from peak levels but 2025/2026 should see an acceleration in growth fueled by more complex architecture and new materials like molybdenum. ENTG tends to grow faster than the semiconductor industry and a higher material intensity to sustain Moore’s law will benefit the company.

ENTG has a defensive business model with 75% of its revenue coming from chip volumes manufactured. The revenue does not depend on the price of chips, with a high switching cost that would enable ENTG to retain its business. A superior yield is also another factor why the business has been recurring in nature.

The high-margin filtration business is also set to achieve maximum utilization from 2025/2026 after the new plant in Taiwan becomes operative. This facility should drive EBIT higher by 20% and offer a 30% ROIC. Margins are also expected to be lucrative since the company enjoys a duopolistic position with Danaher.

ENTG should register a growth rate of mid-teens in the next few years. A 2026 EPS greater than $6 looks realistic with better margins. With an earnings multiple of ~20x, the fair value of the stock should be $140-150, offering a potential upside of 45% by the 2025 year-end.

While we acknowledge the potential of ENTG as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ENTG but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.