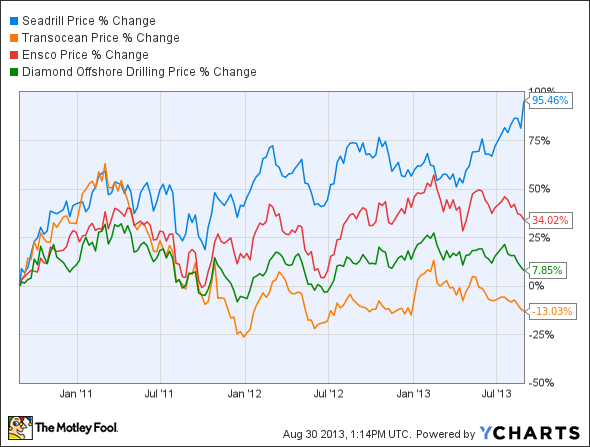

The story of Seadrill Ltd (NYSE:SDRL) has been a bit of a rosy one for the past several years. It has emerged as a darling of service companies as its fleet of ultra-deepwater capable assets has one of the best safety and operational performance records. This, plus its rapidly expanding fleet of high performance rigs has led to exceptional growth over the past few years, but it has come at the cost of taking on a sizable debt load. Can the company’s growth keep pace with it’s debt load? Let’s take a look at what’s coming down the pipe for Seadrill Ltd (NYSE:SDRL) to see if it has the legs.

Growth comes at a cost

There is one thing that separates Seadrill Ltd (NYSE:SDRL) from its competitors, the age and the technical specifications of its fleet. The average age of its floating assets–which are either semisubmersible rigs or drillships– is less than half of its next competitor ENSCO PLC (NYSE:ESV). These two elements mean two critical things to Seadrill Ltd (NYSE:SDRL)’s success, the company can charge a premium for its rigs, and the company has much less downtime for repairs and turnarounds.

Source: Seadrill Investor Presentation

| Company | Gross Margin |

| Seadrill | 60.7% |

| Ensco | 52.3% |

| Transocean | 32.9% |

| Diamond Offshore | 49% |

Source: S&P Capital IQ

At the same time, the company is undertaking a rather ambitious growth plan. Seadrill has plans in place to almost double the size of its fleet by 2016. To make much of this happen, the company has taken on a sizable debt load. Seadrill Ltd (NYSE:SDRL)’s current debt load stands at 61.5%, another metric where the company stands out from its peers.

| Company | Net debt (in $millions) | Debt-to-Capital |

| Seadrill | 10,968 | 61.15% |

| Ensco | 4,316 | 28.07% |

| Transocean | 7,442 | 40.81% |

| Diamond Offshore | 276 | 24.2% |

Source: S&P Capital IQ

Sometimes, the type of debt is just as important than the actual debt load. In the case of Seadrill, this isn’t as encouraging either. Of that $10 billion outstanding, $4.4 billion of it is due before year end 2015. This could potentially disrupt its expansion plans as it finances its debt obligations.

Tackling the debt

Then again, the size of that debt obligation could be mitigated if the company is able to grow fast enough. This appears to be the company’s plan. The addition of those 27 jack-ups, semi-submersibles, and drillships is expected to almost double the company’s current EBITDA to $4.5 billion by 2016. More importantly, almost 30% of those new rigs will be coming online by the end of this year. With an order backlog of about $19 billion on the books, Seadrill Ltd (NYSE:SDRL) will be able to put those assets to work immediately.

Seadrill also has another arrow in the quiver that it can use to help mitigate that debt risk as well. The recent spin off of Seadrill Partners LLC (NYSE:SDLP) as a Master Limited Partnership allows the company to drop down assets into the MLP holding company in exchange for cash. This trend has emerged among several other sub-sectors of the oil and gas industry and it would not be too surprising to see other rig companies follow a similar path.

What a Fool Believes

If the debt levels are just a little too scary for you as an investor, then ENSCO PLC (NYSE:ESV) might be worth considering. The company has been able to keep much of its fleet in operation with a rig utilization rate of about 95%. Also, ENSCO PLC (NYSE:ESV) has been able to post comparable margins to those of Seadrill, but the company has a much more favorable debt profile. However, ENSCO PLC (NYSE:ESV)’s growth plans are much more modest than Seadrill’s and ENSCO PLC (NYSE:ESV)’s 3.5% dividend yield seems almost paltry in comparison to Seadrill’s 8.1%

Overall, the threat of debt for Seadrill Ltd (NYSE:SDRL) is certainly present, but based on the company’s growth prospects it should be able to cover its hefty obligations down the road. Also, unlike some of its peers, it has been able to resolve some labor related cost issues in some of the fastest growing markets, most notably Brazil, Angola, and Nigeria. These regions, which are both estimated to hold massive reserves in very deep pre-salt formations, will be a driving force in the offshore business for years to come. So seeing that Seadrill has made some progress in controlling costs in these regions is very encouraging for the future.

The article Can Seadrill’s Growth Outpace a Potential Debt Problem? originally appeared on Fool.com and is written by Tyler Crowe.

Fool contributor Tyler Crowe has no position in any stocks mentioned. You can follow him at Fool.com under the handle TMFDirtyBird, on Google +, or on Twitter: @TylerCroweFool.The Motley Fool recommends Seadrill. The Motley Fool owns shares of Seadrill and Transocean.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.