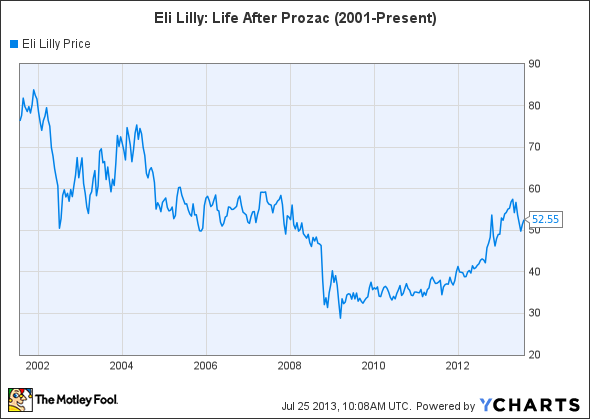

For Eli Lilly & Co. (NYSE:LLY), history is repeating itself once again. The pharmaceutical company, which became a household name with its antidepressant Prozac in 1987, slipped in 2001 after it lost patent protection for its flagship drug. Over the following decade, Eli Lilly was unable to relive its Prozac-induced euphoria between 1987 and 2001, and shares have fallen nearly 30% over the past twelve years.

Later this year, Eli Lilly & Co. (NYSE:LLY) faces the patent expiration of its biggest seller, the antidepressant Cymbalta, while generic versions of its osteoporosis drug Evista will arrive in early 2014. The company forecasts that these two patent expirations will reduce its global revenue by 20% next year, and it has already suspended pay increases for most employees to reduce costs.

With things looking so bleak, should investors still stick with this stock, which has woefully underperformed the market over the past twelve months?

In the second quarter, Eli Lilly earned $1.16 per share, up 40% from the prior year quarter and topping the consensus estimate by 15 cents. Revenue rose 6% to $5.93 billion, also beating the $5.82 billion that analysts had forecast. The company attributed these gains to a combination of higher prices and sales volume, which was slightly offset by unfavorable foreign exchange impacts.

Cymbalta was Lilly’s top seller this quarter, reporting 22% year-on-year revenue growth to $1.5 billion. Sales of Cialis, its impotence treatment, rose 13% to $529.4 million. Sales of osteoporosis treatment Forteo climbed 7% to $296.9 million, Evista increased 5% to $279 million, and its biosynthetic insulin Humulin gained 8% to $347.5 million. Sales at its Animal Health segment rose 6% to $543.5 million.

However, sales of Zyprexa, an antipsychotic treatment that was once Eli Lilly & Co. (NYSE:LLY)’s cash cow, plunged 25% to $283.2 million, due to lower prices in the United States and a loss of patent exclusivity in multiple key markets.

Past performance is not an indicator of future gains

Yet the stock market is all about looking at future gains, and not past performance. The decline of Zyprexa bodes ill for Lilly, which will face the same dilemma with Cymbalta later this year. More than five generic companies are already gearing up to release generic Cymbalta early next year, which would fragment the market, cause prices to decline, and severely dent Lilly’s revenue growth. The loss of exclusivity over Evista is expected to exacerbate that top-line decline. Together, the two drugs accounted for 30% of Lilly’s revenue last quarter.

In addition, the market for antidepressants, which Lilly has long dominated with Prozac and Cymbalta, is now saturated, mostly by generics. Most of the major brands, such as a Prozac, Zoloft, and Paxil, lost their patent protection over the past decade. This means that Lilly must expand in another direction to grow its top-line again.

Not all hope is lost

To address concerns of its upcoming patent expirations, Lilly updated investors on several key drugs in its pipeline. The company’s marketing authorization application for LY2963016, an investigational, long-acting insulin for type 1 and type 2 diabetes, is being reviewed by the European Medicines Agency. Lilly also announced positive Phase III trial data for several late-stage investigational diabetes medications. For all of these investigational treatments, Lilly has been collaborating with Boehringer Ingelheim.

Two of Lilly’s most encouraging diabetes treatments are dulaglutide and empagliflozin. Dulaglutide is a once-a-week injection for adult-onset diabetes, and helped patients lose weight and control their blood sugar levels better than existing treatments. Empagliflozin is administered with insulin, and a 78-week study found that patients’ blood sugar levels decreased more than with regular insulin doses. Empagliflozin removes excess blood sugar through the urine. In addition to its diabetes treatments, Lilly is also working on a stomach and breast cancer treatment, and a new type of cholesterol medication.

However, I believe that Lilly’s injection-based diabetes treatments could face some steep competition from its industry peers.