During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Edgewell Personal Care Company (NYSE:EPC) and see how the stock is affected by the recent hedge fund activity.

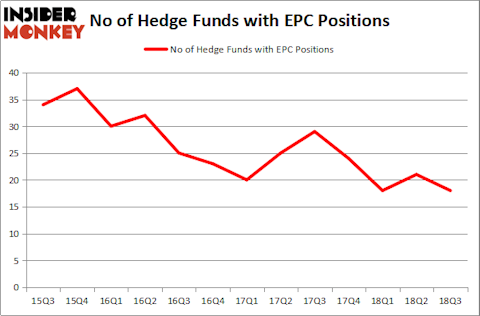

Edgewell Personal Care Company (NYSE:EPC) was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. EPC investors should be aware of a decrease in enthusiasm from smart money of late. There were 21 hedge funds in our database with EPC positions at the end of the previous quarter. Our calculations also showed that EPC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the new hedge fund action regarding Edgewell Personal Care Company (NYSE:EPC).

How are hedge funds trading Edgewell Personal Care Company (NYSE:EPC)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards EPC over the last 13 quarters. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, GAMCO Investors held the most valuable stake in Edgewell Personal Care Company (NYSE:EPC), which was worth $88.6 million at the end of the third quarter. On the second spot was Legion Partners Asset Management which amassed $51.9 million worth of shares. Moreover, Armistice Capital, Citadel Investment Group, and Millennium Management were also bullish on Edgewell Personal Care Company (NYSE:EPC), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Edgewell Personal Care Company (NYSE:EPC) has witnessed falling interest from the smart money, we can see that there were a few hedgies that slashed their entire stakes last quarter. Intriguingly, Steven Boyd’s Armistice Capital sold off the largest stake of the 700 funds tracked by Insider Monkey, valued at close to $17.7 million in stock, and Craig C. Albert’s Sheffield Asset Management was right behind this move, as the fund said goodbye to about $6.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Edgewell Personal Care Company (NYSE:EPC) but similarly valued. We will take a look at Mimecast Limited (NASDAQ:MIME), Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), Artisan Partners Asset Management Inc (NYSE:APAM), and Companhia Energetica de Minas Gerais (NYSE:CIG). This group of stocks’ market values match EPC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIME | 26 | 540249 | 6 |

| MDRX | 20 | 249789 | -2 |

| APAM | 13 | 124514 | 0 |

| CIG | 6 | 3508 | -1 |

| Average | 16.25 | 229515 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $230 million. That figure was $265 million in EPC’s case. Mimecast Limited (NASDAQ:MIME) is the most popular stock in this table. On the other hand Companhia Energetica de Minas Gerais (NYSE:CIG) is the least popular one with only 6 bullish hedge fund positions. Edgewell Personal Care Company (NYSE:EPC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MIME might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.