Stanley Black & Decker Inc.’s analysis versus peers uses the following peer-set: Makita Corporation (NASDAQ:MKTAY), Snap-on Incorporated (NYSE:SNA), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), Kennametal Inc. (NYSE:KMT), Husqvarna AB (STO:HUSQ-B), The Toro Company (NYSE:TTC) and HIWIN TECH CORP TWD10 (TPE:2049). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

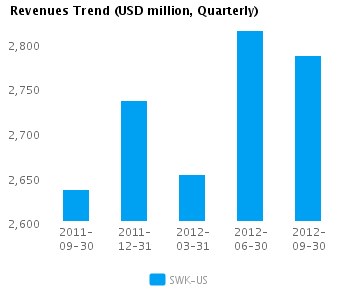

| Quarterly (USD million) | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 |

|---|---|---|---|---|---|

| Revenues | 2,786.7 | 2,814.2 | 2,652.9 | 2,736.1 | 2,636.4 |

| Revenue Growth % | (1.0) | 6.1 | (3.0) | 3.8 | 0.5 |

| Net Income | 115.2 | 154.8 | 121.8 | 163.8 | 154.6 |

| Net Income Growth % | (25.6) | 27.1 | (25.6) | 6.0 | (21.6) |

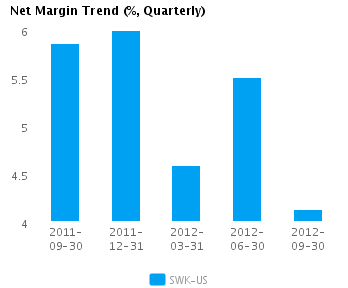

| Net Margin % | 4.1 | 5.5 | 4.6 | 6.0 | 5.9 |

| ROE % (Annualized) | 6.6 | 8.8 | 6.9 | 9.3 | 8.5 |

| ROA % (Annualized) | 2.8 | 3.8 | 3.0 | 4.0 | 3.8 |

Valuation Drivers

Stanley Black & Decker Inc.’s current Price/Book of 1.7 is about median in its peer group. The market expects SWK-US to grow faster than the median of its chosen peers (PE of 21.6 compared to peer median of 15.1) and to improve its current ROE of 7.8% which is below its peer median of 18.4%. Thus, the market seems to expect a turnaround in SWK-US’s current performance.

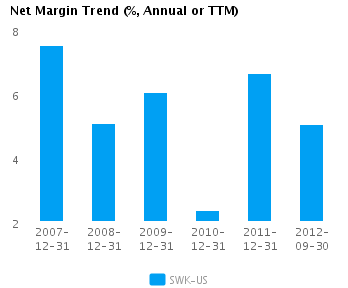

The company does not seem to have a viable operating strategy as is evident from low net profit margins (currently 5.1% vs. peer median of 9.1%) and poor asset turns (currently 0.7x compared to peer median of 0.9x). We classify this operating model as problematic relative to its peers. SWK-US’s net margin is similar to its five-year average net margin of 5.5%.

Economic Moat

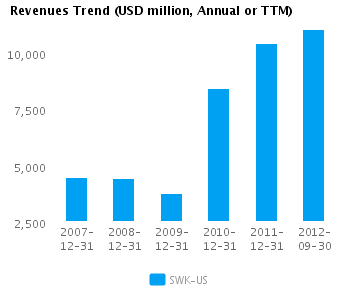

The company enjoys both better than peer median annual revenue growth of 23.4% and better than peer median earnings growth performance 248.1%. SWK-US currently converts every 1% of change in annual revenue into 10.6% of change in annual reported earnings. We view this company as a leader among its peers.

SWK-US’s return on assets is less than its peer median currently (3.3% vs. peer median 9.5%). It has also had less than peer median returns on assets over the past five years (4.7% vs. peer median 7.8%). This performance suggests that the company has persistent operating challenges relative to peers.

The company’s gross margin of 39.9% is around peer median suggesting that SWK-US’s operations do not benefit from any differentiating pricing advantage. In addition, SWK-US’s pre-tax margin is less than the peer median (6.3% compared to 13.2%) suggesting relatively high operating costs.

Growth & Investment Strategy

SWK-US has grown its revenues faster than its peers (32.8% vs. 5.7% respectively for the past three years). The market also sees relatively higher long-term growth prospects for the company, giving it a better than peer median PE ratio of 21.6. Overall, we classify the company’s growth prospects as superior relative to its peers.

SWK-US’s annualized rate of change in capital of 46.4% over the past three years is greater than the peer median of 9.4%. This relatively high investment has generated a less than peer median return on capital of 5.4% averaged over the same three years. The relatively high investment and low current returns lead us to believe that the company is betting heavily on the future.

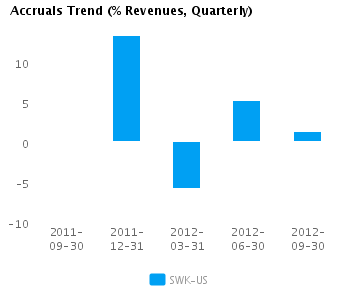

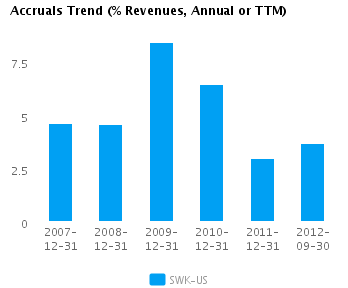

Earnings Quality

Trend Charts

Company Profile

Disclaimer

This article was originally written by abha.dawesar, and posted on CapitalCube.