NV Energy Inc.’s analysis versus peers uses the following peer-set: PG&E Corporation (NYSE:PCG), Edison International (NYSE:EIX), Xcel Energy Inc (NYSE:XEL), Pinnacle West Capital Corporation (NYSE:PNW), IDACORP Inc (NYSE:IDA), Southwest Gas Corporation (NYSE:SWX), PNM Resources, Inc. (NYSE:PNM), UNS Energy Corp (NYSE:UNS), Avista Corp (NYSE:AVA) and CH Energy Group Inc (NYSE:CHG). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

| Quarterly (USD million) | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 |

|---|---|---|---|---|---|

| Revenues | 1,026.5 | 740.7 | 611.4 | 609.6 | 1,017.8 |

| Revenue Growth % | 38.6 | 21.1 | 0.3 | (40.1) | 50.8 |

| Net Income | 223.2 | 69.4 | 12.2 | (25.2) | 173.5 |

| Net Income Growth % | 221.4 | 470.4 | N/A | (114.6) | 1,245.9 |

| Net Margin % | 21.7 | 9.4 | 2.0 | (4.1) | 17.0 |

| ROE % (Annualized) | 25.5 | 8.2 | 1.4 | (2.9) | 20.5 |

| ROA % (Annualized) | 7.5 | 2.4 | 0.4 | (0.9) | 5.9 |

Valuation Drivers

NV Energy Inc.’s current Price/Book of 1.2 is about median in its peer group. The market expects NVE-US to grow at about the same rate as its chosen peers (PE of 16.2 compared to peer median of 16.2) and to maintain the peer median return (ROE of 7.9%) it currently generates.

The company’s relatively high profit margins (currently 9.4% vs. peer median of 6.2%) are burdened by asset inefficiency with asset turns of 0.3x compared to the peer median of 0.3x. Overall, this suggests a margin driven operating model relative to its peers. NVE-US’s net margin is its highest relative to the last five years and compares to a low of 5.1% in 2009.

Economic Moat

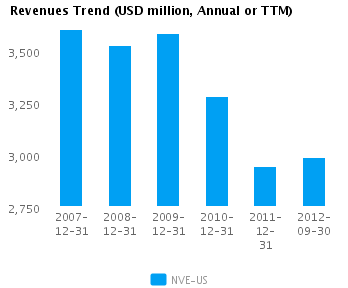

Changes in the company’s annual top line and earnings (-10.3% and -28.0% respectively) generally lag its peers. This implies a lack of strategic focus and/or inability to execute. We view such companies as laggards relative to peers.

NVE-US’s return on assets currently is around peer median (2.4% vs. peer median 2.4%) — similar to its returns over the past five years (1.8% vs. peer median 2.2%). This performance suggests that the company has no specific competitive advantages relative to its peers.

The company’s gross margin of 57.6% is around peer median suggesting that NVE-US’s operations do not benefit from any differentiating pricing advantage. However, NVE-US’s pre-tax margin is more than the peer median (14.6% compared to 9.3%) suggesting relatively tight control on operating costs.

Growth & Investment Strategy

While NVE-US’s revenues growth has been below the peer median in the last few years (-5.9% vs. -1.7% respectively for the past three years), the market still gives the stock an about peer median PE ratio of 16.2. The market seems to see the company as a long-term strategic bet.

NVE-US’s annualized rate of change in capital of 0.6% over the past three years is less than its peer median of 1.8%. This below median investment level has also generated a less than peer median return on capital of 2.2% averaged over the same three years. This outcome suggests that the company has invested capital relatively poorly and now may be in maintenance mode.

Earnings Quality

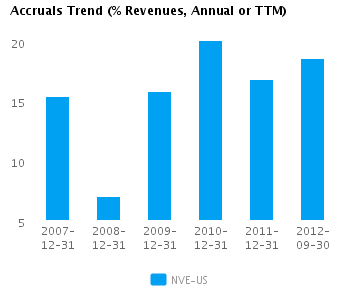

NVE-US has reported relatively strong net income margin for the last twelve months (9.4% vs. peer median of 6.2%). This margin performance combined with relatively high accruals (18.6% vs. peer median of 13.5%) suggests possible conservative accounting and an understatement of its reported net income.

NVE-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts