Monsanto Company (NYSE:MON) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visitwww.capitalcube.com.

Monsanto Co.’s analysis versus peers uses the following peer-set: BASF SE (PINK:BASFY), E I Du Pont De Nemours And Co (NYSE:DD), The Dow Chemical Company (NYSE:DOW), Syngenta AG (NYSE:SYT), Archer Daniels Midland Company (NYSE:ADM), CF Industries Holdings, Inc. (NYSE:CF), Bunge Limited (NYSE:BG) and FMC Corporation (NYSE:FMC). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

Valuation Drivers

Monsanto Co.’s current Price/Book of 3.9 is about median in its peer group. The market expects more growth from MON-US than the median of its chosen peers (PE of 23.5 compared to peer median of 15.2) and to improve its current ROE of 17.3% which is around peer median.

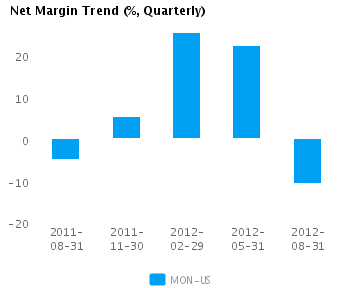

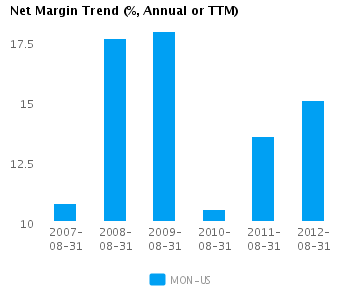

The company’s relatively high profit margins (currently 15.1% vs. peer median of 8.8%) are burdened by asset inefficiency with asset turns of 0.7x compared to the peer median of 0.9x. Overall, this suggests a margin driven operating model relative to its peers. MON-US’s net margin continues to trend upward and is above (but within one standard deviation of) its five-year average net margin of 14.1%.

Economic Moat

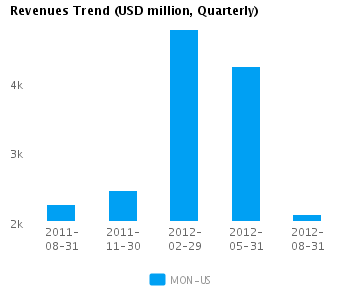

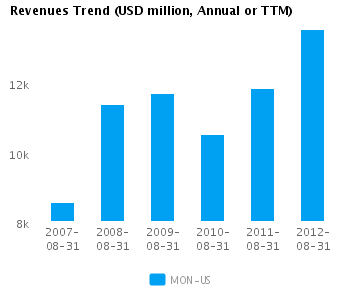

Changes in the company’s revenues are in-line with its peers (annual revenue changed by 14.2%) but its earnings performance has been better — its annual earnings changed by 27.0% compared to the peer median of 17.4%, implying that it has better cost control relative to its peers. MON-US currently converts every 1% of change in revenue into 1.9% of change in annual reported earnings.

MON-US’s return on assets is above its peer median both in the current period (10.2% vs. peer median 8.4%) and also over the past five years (9.9% vs. peer median 7.3%). This performance suggests that the company’s relatively high operating returns are sustainable.

The company’s comparatively healthy gross margin of 56.4% versus peer median of 31.8% suggests that it has a differentiated strategy with pricing advantages. Further, MON-US’s bottom-line operating performance is better than peer median (pre-tax margins of 22.1% compared to peer median 11.4%) suggesting relatively tight control on operating costs.

Growth & Investment Strategy

While MON-US’s revenues growth has been around the peer median in recent years (5.0% vs. 4.3% respectively for the past three years), the market gives its shares a higher than peer median PE ratio of 23.5. The market seems to see faster growth ahead.

MON-US’s annualized rate of change in capital of 6.0% over the past three years is less than its peer median of 9.2%. This investment has generated a peer median return on capital of 12.1% averaged over the same three years. The median return on capital investment on a relatively lower investment suggests that the company is under investing.

Earnings Quality

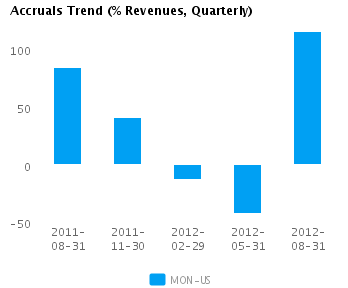

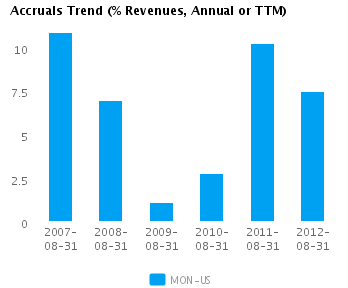

MON-US has reported relatively strong net income margin for the last twelve months (15.1% vs. peer median of 8.8%). This margin performance combined with relatively high accruals (7.5% vs. peer median of 2.8%) suggests possible conservative accounting and an understatement of its reported net income.

MON-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts