Accenture Plc (NYSE:ACN) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visit www.capitalcube.com.

Accenture PLC’s analysis versus peers uses the following peer-set: International Business Machines Corp. (NYSE:IBM), SAP AG (NYSE:SAP), Infosys Ltd (NASDAQ:INFY), Wipro Limited (NYSE:WIT), Cognizant Technology Solutions Corp (NASDAQ:CTSH), Cap Gemini SA (EPA:CAP) and Computer Sciences Corporation (NYSE:CSC). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

Valuation Drivers

Accenture PLC’s current Price/Book of 11.5 is about median in its peer group. ACN-US’s operating performance is higher than the median of its chosen peers (ROE of 63.6% compared to the peer median ROE of 26.3%) but the market does not seem to expect higher growth relative to peers (PE of 18.2 compared to peer median of 17.7) but simply to maintain its relatively high rates of return.

The company’s net profit margins have been relatively poor (currently 8.6% vs. peer median of 14.5%) while its asset efficiency is better than the median (asset turns of 1.8x compared to peer median of 1.0x). This suggests a volume driven operating model relative to its peers. ACN-US’s net margin is its highest relative to the last five years and compares to a low of 5.8% in 2007.

Economic Moat

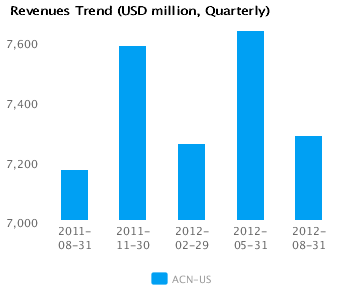

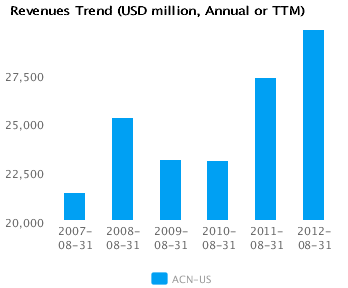

The company’s top line performance is not as good as its peers (year-on-year change in revenue is 8.9%) but its earnings performance (12.1% change year-on-year) has been similar to the peer median. Unless the company maintains or improves this relative earnings growth, it is in danger of lagging its peers. ACN-US currently converts every 1% of change in revenue into 1.4% of change in annual reported earnings.

ACN-US’s return on assets currently is around peer median (15.8% vs. peer median 15.0%) — similar to its returns over the past five years (14.7% vs. peer median 14.8%). This performance suggests that the company has no specific competitive advantages relative to its peers.

The company’s gross margin of 32.2% is around peer median suggesting that ACN-US’s operations do not benefit from any differentiating pricing advantage. In addition, ACN-US’s pre-tax margin is less than the peer median (13.1% compared to 18.7%) suggesting relatively high operating costs.

Growth & Investment Strategy

While ACN-US’s revenues have grown faster than the peer median (8.7% vs. 7.1% respectively for the past three years), the market gives the stock an about peer median PE ratio of 18.2. This suggests that the market has some questions about the company’s long-term strategy.

ACN-US’s annualized rate of change in capital of 12.8% over the past three years is around the same as its peer median of 15.6%. This investment has generated a better than peer median return on capital of 64.5% averaged over the same three years. The greater than peer median rate of return suggest that the company may be under investing in growth.

Earnings Quality

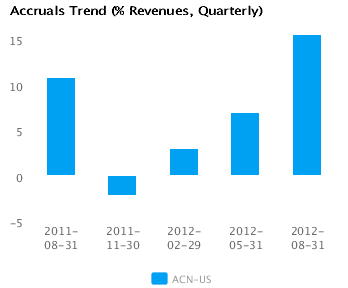

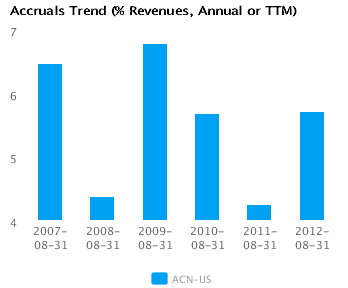

ACN-US reported relatively weak net income margins for the last twelve months (8.6% vs. peer median of 14.5%). This weak margin performance and relatively conservative accrual policy (5.7% vs. peer median of 1.8%) suggest the company might likely be understating its net income, possibly to the extent that there might even be some sandbagging of the reported net income numbers.

ACN-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts