We recently published a list of Top 10 AI News and Analyst Ratings You Should Not Miss. Since ON Semiconductor Corp (NASDAQ:ON) ranks 7th on the list, it deserves a deeper look.

Investors are on tenterhooks as Jensen Huang’s AI giant is about to release earnings. Gene Munster, Deepwater Asset Management managing partner, said in an interview with CNBC that the broader market can see a pullback if Blackwell-related delays show a wider impact on the AI chips market. The analyst predicted that it’s going to be a “difficult week” for major tech companies.

However, Munster is highly bullish on the broader AI space for the long term.

“I still think that we are in an early innings of a 3 to 5 year tech bull market that is powered by AI, and I think all these big tech companies are going to do well over the next couple of years,” Munster said.

The analyst said that Jensen Huang has indicated in the previous quarters that the demand for AI chips is more than what his company could manage in the short term, and if he reiterates this in the upcoming results, it would give a strong signal to investors about the AI potential.

“There is a lot of awareness about AI but I think the significance of what it’s gonna do is still underappreciated by the market.”

In this article, we compiled the most important latest AI news and analyst ratings around major AI tech stocks. With each company we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

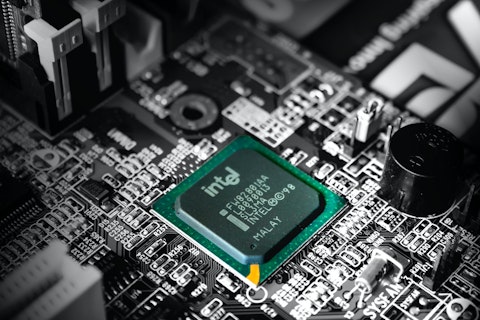

Photo by Slejven Djurakovic on Unsplash

ON Semiconductor Corp (NASDAQ:ON)

Number of Hedge Fund Investors: 45

Bank of America analyst Vivek Arya said in a latest note that if volatility dips in the semiconductor industry and the broader market sees a resurgence, ON Semiconductor Corp (NASDAQ:ON) would be one of the outperformers.

Aristotle Atlantic Large Cap Growth Strategy stated the following regarding ON Semiconductor Corporation (NASDAQ:ON) in its Q2 2024 investor letter:

“We sold ON Semiconductor Corporation (NASDAQ:ON) and have become more cautious on the global automotive market, especially for electric vehicles, which we believe will see a period of slower sales due to both new infrastructure requirements and consumers becoming more knowledgeable about the potential costs and issues with owning EVs. In addition, the market is becoming a lot more competitive on the supply side, with many new models being launched simultaneously, which we believe will lead to pricing pressures for the OEMs, which could create pricing headwinds for suppliers such as ON Semiconductor. While we see global EV penetration as continuing to increase over the next decade, supported by government incentives, we remain cautious in the near term and believe we are entering a period of lower sales trends following the explosive growth of the past three years.”

Overall, ON Semiconductor Corp (NASDAQ:ON) ranks 7th on Insider Monkey’s list titled Top 10 AI News and Analyst Ratings You Should Not Miss. While we acknowledge the potential of ON, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ON but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. This article is originally published at Insider Monkey.