Dollar General Corp. (NYSE:DG), despite its name, is not a “dollar store” in the traditional sense. Not all of their items cost $1.00, and in fact their merchandise costs up to $10, with just about 25% of their merchandise costing $1.00 or less. What I was thinking is that maybe Dollar General Corp. (NYSE:DG) is perhaps a nice compromise between bargain-basement dollar stores and more upscale, traditional retailers. Even though shares are very close to their all-time highs, I think this rapidly growing retailer is still cheap.

About Dollar General

Dollar General Corp. (NYSE:DG) tries to provide value-seekers with a one-stop shop for virtually all of their necessities. They have more than 10,500 stores which sell food products, cleaning supplies, health and beauty products, and many kinds of discretionary items. The majority (about 70%) of Dollar General’s stores serves small communities, and attributes a lot of their business to being very close to their frequent customers.

One of the company’s main strategies going forward is to expand their grocery business. In fact, during the past year, the company expanded the number of coolers for refrigerated food items in about 1,400 of its stores. They are also constantly trying to expand their profit margins through cost reductions, loss (theft) prevention, and expanding its private brand program.

Rapid Growth, Cheap Valuation

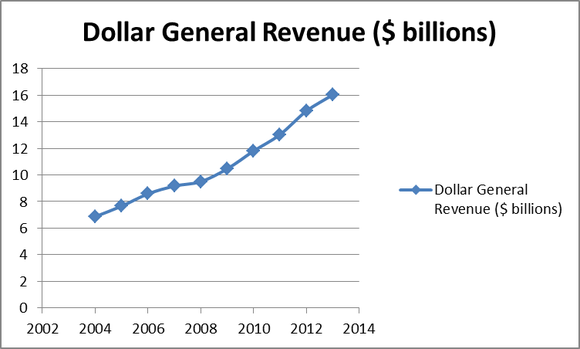

Dollar General Corp. (NYSE:DG) may sound expensive at 19 times last year’s earnings, which admittedly is a lot for a mature retailer. This sounds pretty cheap, though, when you factor in the company’s growth rate. Dollar General’s revenues have nearly doubled in the past six years, and have risen consistently every year during the past decade, particularly during the tumultuous 2008-09 period. Because of the low-priced nature of its products, Dollar General Corp. (NYSE:DG) is a business that works in any economy, good or bad.

Dollar General is projected to earn $3.28 per share for the current fiscal year (2014), and is expected to grow earnings to $3.79 and $4.49 in fiscal years 2015 and 2016, respectively. This translates to a three year annual earnings growth rate of 15.6%, which justifies the seemingly high P/E ratio and then some.

Alternative Investments

Before we go diving in to Dollar General, let’s take a quick look at what else is out there. As we mentioned a little earlier, Dollar General is somewhat in the middle of dollar stores and large retailers, so let’s take a look at one of each.

Unlike Dollar General, Dollar Tree, Inc. (NASDAQ:DLTR) sells all of its items for $1.00 or less, making it a true “dollar store.” Dollar Tree, Inc. (NASDAQ:DLTR) is slightly smaller with just under 5,000 stores and their basic strategy is to impress the customer with what can be purchased for a dollar. Dollar Tree trades for a similar valuation to Dollar General at 18 times TTM earnings, and is projected to grow at a 15% rate going forward, making it look almost identical to Dollar General from a valuation perspective. Out of the two, I prefer Dollar General simply because I believe that their business model of selling items above $1.00 opens them up to more potential growth, particularly in food sales and beer/wine sales, which the company has just begun to implement.