Diamond Hill Capital, an investment management company, released its “Select Strategy” second-quarter 2024 investor letter. A copy of the letter can be downloaded here. In Q2, markets saw a modest boost, delivering positive returns across the majority of regions and nations. The Russell 3000 Index showed a +3% increase in US stocks; however, the majority of the gains came from large-cap stocks, which increased by about +4%. Returns were negative across the cap spectrum, with mid-caps and small caps, as indicated by their respective Russell indices, each down about -3%. The portfolio underperformed the Russell 3000 Index in Q2 and returned -4.96% net of fees compared to 3.22% for the index. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2024.

Diamond Hill Select Strategy highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the second quarter 2024 investor letter. Texas Instruments Incorporated (NASDAQ:TXN) is a semiconductor manufacturer. The one-month return of Texas Instruments Incorporated (NASDAQ:TXN) was 1.30%, and its shares gained 12.68% of their value over the last 52 weeks. On July 30, 2024, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $200.99 per share with a market capitalization of $183.513 billion.

Diamond Hill Select Strategy stated the following regarding Texas Instruments Incorporated (NASDAQ:TXN) in its Q2 2024 investor letter:

“Among our top individual contributors in Q2 were Amazon, Texas Instruments Incorporated (NASDAQ:TXN) and Mr. Cooper Group. Shares of semiconductor manufacturing company Texas Instruments rose in Q2 as demand in several of the company’s end markets show signs of recovering. Given the company’s long-term prospects, competitive positioning and scale advantages, we believe the outlook for the company from here is strong.”

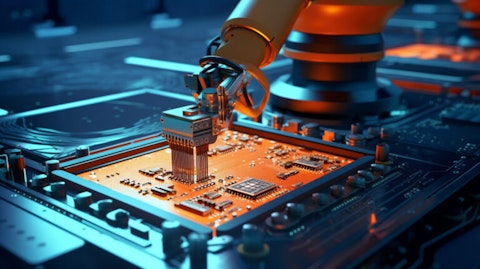

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 49 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of the first quarter which was 55 in the previous quarter. The first quarter revenue of Texas Instruments Incorporated (NASDAQ:TXN) was $3.8 billion, up 4% sequentially and down 16% year-over-year. While we acknowledge the potential of Texas Instruments Incorporated (NASDAQ:TXN) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Texas Instruments Incorporated (NASDAQ:TXN) and shared Madison Investors Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.