Health is priceless; health care isn’t.

As a pharmaceutical company, Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) benefits from many of the unique elements of the industry that make it attractive for dividend investors. We all know it’s impossible to put a price on one’s health and well-being. Because of that, and due to the unbearable cost of emergency health problems, insurance companies and government entitlement programs have taken over as the gatekeepers of health care spending around the world.

But the industry’s high costs didn’t just appear out of thin air. Partly to blame is the fact that our insurance systems have effectively masked the direct costs of health care by turning the system into a kind of all-you-can-eat buffet, removing most of the consumer-driven pricing mechanisms that exist in practically every other industry. This dynamic, along with the aging and increasingly unhealthy society that we’re all well aware of, is a key reason health care spending will continue to grow.

But while these big picture trends might be driving the overall industry, investors looking at specific health care dividend stocks need to dig a layer deeper to understand the company-specific issues at work. After all, dividends aren’t a guarantee, and if the going gets tough enough, even a “stable” health care stock could cut — or eliminate — its dividend. With that being said, let’s check on where Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA)’s dividend has been and try to determine where it’s going.

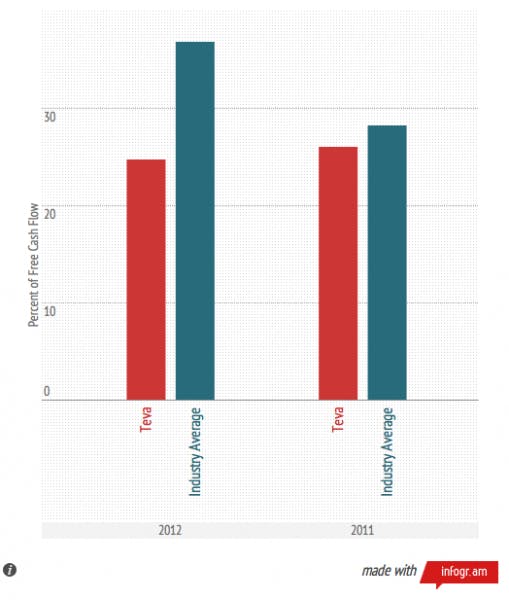

Payout ratios

A quick-and-dirty technique for checking a dividend’s sustainability is taking a look at something called the payout ratio. Typically this is expressed as a percentage, looking at a company’s dividend per share relative to its net income per share. That’s a decent start, but I prefer to use a slightly different measurement that replaces net income, an accounting measurement, with something more tangible — cold hard cash. The chart below shows how much of Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA)’s free cash flow has been eaten up by its dividend payments over the past two years. The lower the better, suggesting more capacity for future dividend hikes.

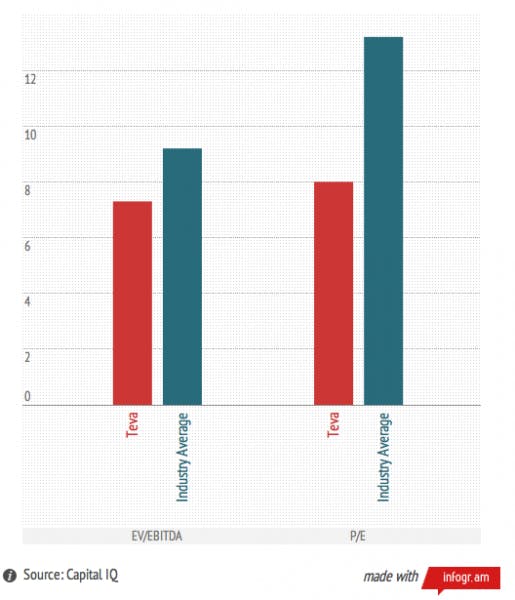

Not all dividends are created equal. At first glance a high dividend yield may look nice, but all too often it means a problem is lurking around the corner for a business. Looking at Teva’s 3% dividend yield in isolation only tells half of the story, which is why investors need to have an understanding of how the market perceives a company prior to buying a stock. We can do this by comparing a few financial multiples, like price to earnings, to its peers in the industry.

Up to this point, we’ve looked at Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA)’s dividend in the past, and we’ve also seen how its stock is being perceived by the market today. However, the most important factor to consider when understanding a dividend’s future is where the company’s cash flow is heading. It’s hard to generate more cash without growing sales, so let’s take a look at what industry analysts are expecting for Teva’s revenue growth relative to peers this year.

As a leading generic pharmaceuticals company, Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) usually benefits when top selling branded drugs lose patent protection. But the company also sells numerous branded drugs, and it’s facing a patent expiration in 2015 for Copaxone, which accounted for around 20% of sales in 2012.

Fewer generic drugs to copy, as well as Copaxone’s patent loss, will certainly hurt revenue growth over the next few years. Despite the sluggish growth outlook, given the company’s reasonable payout ratio today and the stability offered by its generic business, I think Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) will be able to maintain, and grow, its dividend slightly over the next few years.

The article Does Teva’s Dividend Have Room to Soar? originally appeared on Fool.com and is written by Brenton Flynn.

Brenton Flynn has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.