A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Southern First Bancshares, Inc. (NASDAQ:SFST).

Hedge fund interest in Southern First Bancshares, Inc. (NASDAQ:SFST) shares was flat during the third quarter. This is usually a negative indicator. At the end of this article we will also compare SFST to other stocks including First Northwest BanCorp (NASDAQ:FNWB), Codorus Valley Bancorp, Inc. (NASDAQ:CVLY), and Central Valley Community Bancorp (NASDAQ:CVCY) to get a better sense of its popularity.

Follow Southern First Bancshares Inc (NASDAQ:SFST)

Follow Southern First Bancshares Inc (NASDAQ:SFST)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Andrey_Popov/shutterstock.com

How have hedgies been trading Southern First Bancshares, Inc. (NASDAQ:SFST)?

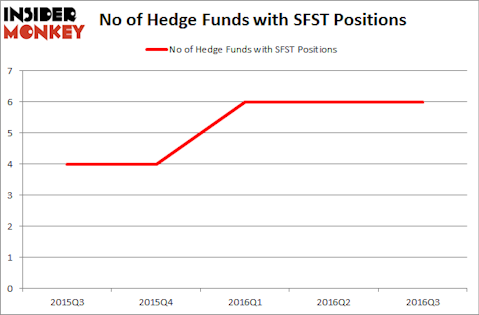

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from one quarter earlier. Aside from a Q1 jump in ownership, hedge fund interest in SFST has been flat over the last year. The graph below displays the number of hedge funds with bullish position in SFST over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, EJF Capital, led by Emanuel J. Friedman, holds the most valuable position in Southern First Bancshares, Inc. (NASDAQ:SFST). EJF Capital has a $14.7 million position in the stock, comprising 1.2% of its 13F portfolio. Sitting at the No. 2 spot is Castine Capital Management, led by Paul Magidson, Jonathan Cohen and Ostrom Enders, holding a $3.1 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass Matthew Lindenbaum’s Basswood Capital, Renaissance Technologies, one of the largest hedge funds in the world, and Anton Schutz’s Mendon Capital Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions either. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Southern First Bancshares, Inc. (NASDAQ:SFST) but similarly valued. These stocks are First Northwest BanCorp (NASDAQ:FNWB), Codorus Valley Bancorp, Inc. (NASDAQ:CVLY), Central Valley Community Bancorp (NASDAQ:CVCY), and Regulus Therapeutics Inc (NASDAQ:RGLS). This group of stocks’ market values resemble SFST’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNWB | 4 | 14324 | -1 |

| CVLY | 3 | 9360 | -1 |

| CVCY | 4 | 9864 | 4 |

| RGLS | 9 | 8328 | 4 |

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $22 million in SFST’s case. Regulus Therapeutics Inc (NASDAQ:RGLS) is the most popular stock in this table. On the other hand Codorus Valley Bancorp, Inc. (NASDAQ:CVLY) is the least popular one with only 3 bullish hedge fund positions. Southern First Bancshares, Inc. (NASDAQ:SFST) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RGLS might be a better candidate to consider taking a long position in.

Disclosure: None