Scout Investments, Inc, an affiliate of Carillon Tower Advisers, released the “Carillon Scout Mid Cap Fund” first quarter 2024 investor letter. A copy of the letter can be downloaded here. In the first quarter, most indices generated significant gains driven by more cyclical industries including energy, financials, and industrials. The combination of a positive outlook for monetary policy, low unemployment, and strong earnings growth expectations lifted the S&P 500 Index to an all-time high in the first quarter. The Russell 2000 Index continued to trade considerably below its peak, while the Russell Midcap Index neared its 2021 high. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Carillon Scout Mid Cap Fund highlighted stocks like Edwards Lifesciences Corporation (NYSE:EW), in the first quarter 2024 investor letter. Edwards Lifesciences Corporation (NYSE:EW) offers products and technologies for structural heart disease and critical care monitoring. The one-month return of Edwards Lifesciences Corporation (NYSE:EW) was -1.87%, and its shares lost 2.82% of their value over the last 52 weeks. On June 18, 2024, Edwards Lifesciences Corporation (NYSE:EW) stock closed at $88.52 per share with a market capitalization of $53.342 billion.

Carillon Scout Mid Cap Fund stated the following regarding Edwards Lifesciences Corporation (NYSE:EW) in its first quarter 2024 investor letter:

“Edwards Lifesciences Corporation (NYSE:EW) was the third-largest contributor. Edwards designs, manufactures and markets products such as heart valves to treat cardiovascular disease. The stock performed well after a competitor delayed, and potentially cancelled, its entry into the aortic heart valve replacement market. Edwards also received approval from the U.S. Food and Drug Administration for its tricuspid valve replacement product much sooner than expected. We continue to find the company’s market position and growth opportunities attractive.”

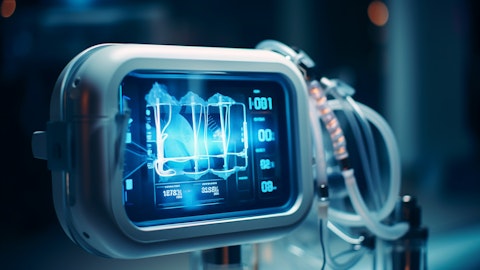

A skilled surgeon surrounded by a team of medical professionals performing a Transcatheter Heart Valve Replacement.

Edwards Lifesciences Corporation (NYSE:EW) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 47 hedge fund portfolios held Edwards Lifesciences Corporation (NYSE:EW) at the end of the first quarter which was 47 in the previous quarter. The first quarter sales of Edwards Lifesciences Corporation (NYSE:EW) were 1.6 million, representing a 10% year-over-year growth. While we acknowledge the potential of Edwards Lifesciences Corporation (NYSE:EW) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Edwards Lifesciences Corporation (NYSE:EW) and shared the list of best medical device stocks to buy. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.