Baron Funds, an investment management firm, released its “Baron Global Advantage Fund” third quarter 2024 investor letter. A copy of the letter can be downloaded here. The fund was up 5.6% (institutional shares) in the third quarter compared to a 6.6% gain for the MSCI ACWI Index (the Index) and a 4.1% gain for the MSCI ACWI Growth Index, the Fund’s benchmark. In the third quarter, global equity indices rose, with several reaching new all-time highs. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2024.

Baron Global Advantage Fund highlighted stocks like Coupang, Inc. (NYSE:CPNG), in the third quarter 2024 investor letter. Coupang, Inc. (NYSE:CPNG) owns and operates retail business through an e-commerce platform. The one-month return of Coupang, Inc. (NYSE:CPNG) was -2.30%, and its shares gained 63.90% of their value over the last 52 weeks. On November 7, 2024, Coupang, Inc. (NYSE:CPNG) stock closed at $25.11 per share with a market capitalization of $45.169 billion.

Baron Global Advantage Fund stated the following regarding Coupang, Inc. (NYSE:CPNG) in its Q3 2024 investor letter:

“Shares of Coupang, Inc. (NYSE:CPNG), Korea’s largest e-commerce marketplace, appreciated 17.2% after second quarter results saw a solid EBITDA beat, driven by higher margins in its core Product Commerce segment (EBITDA of $530 million, up 30% year-on-year, and margins of 8.2%, up 110bps year-on-year). We believe the trend in margin expansion will continue as Coupang scales margin-accretive offerings, improves operations and supply chain, and leverages technology and automation to drive efficiencies. Its food delivery business has experienced strong growth with overall developing offerings revenues up 188% year-on-year in constant currency, with improving unit economics in the recent quarters. We view Coupang as one of the most competitively advantaged e-commerce businesses globally, with significant runway for both revenue and earnings growth.”

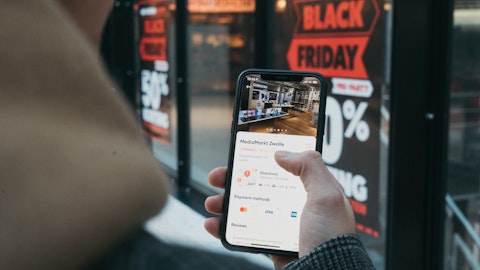

A woman holding a laptop, wearing a graphic t-shirt, casually checking her e-commerce order.

Coupang, Inc. (NYSE:CPNG) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 62 hedge fund portfolios held Coupang, Inc. (NYSE:CPNG) at the end of the second quarter which was 66 in the previous quarter. While we acknowledge the potential of Coupang, Inc. (NYSE:CPNG) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Coupang, Inc. (NYSE:CPNG) and shared the list of best e-commerce stocks to buy according to hedge funds. Baron Global Advantage Fund added its position in Coupang, Inc. (NYSE:CPNG) in Q1 2024, due to its continued strong performance, reporting robust financial results and accelerating revenue growth. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.