Baron Funds, an investment management firm, released its “Baron Global Advantage Fund” third quarter 2024 investor letter. A copy of the letter can be downloaded here. The fund was up 5.6% (institutional shares) in the third quarter compared to a 6.6% gain for the MSCI ACWI Index (the Index) and a 4.1% gain for the MSCI ACWI Growth Index, the Fund’s benchmark. In the third quarter, global equity indices rose, with several reaching new all-time highs. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2024.

Baron Global Advantage Fund highlighted stocks like PDD Holdings Inc. (NASDAQ:PDD), in the third quarter 2024 investor letter. PDD Holdings Inc. (NASDAQ:PDD) is a multinational commerce group that operates through Pinduoduo, an e-commerce platform and Temu, an online marketplace.. The one-month return of PDD Holdings Inc. (NASDAQ:PDD) was -5.97%, and its shares gained 23.56% of their value over the last 52 weeks. On November 7, 2024, PDD Holdings Inc. (NASDAQ:PDD) stock closed at $125.87 per share with a market capitalization of $174.804 billion.

Baron Global Advantage Fund stated the following regarding PDD Holdings Inc. (NASDAQ:PDD) in its Q3 2024 investor letter:

“During the third quarter we re-initiated a small investment in PDD Holdings Inc. (NASDAQ:PDD). We believe the company is truly unique in the global e-commerce landscape, with an innovative business model, and very strong growth prospects. Founded in 2015 as Pinduoduo, the company has grown into China’s second-largest e-commerce player, capturing over 20% market share. PDD’s Consumer-to-Manufacturer (C2M) model, which connects manufacturers directly to consumers eliminated intermediaries, allowing for ultra-low prices that attract price-sensitive consumers and small merchants. Its discovery-based, algorithm-driven shopping experience has created a highly engaging platform, driving user and merchant growth in a virtuous cycle. We expect PDD to continue gaining share in China given its dominance in the value-for-money segment, growing branded product offerings at affordable prices, and high operational efficiency. PDD’s network effects and cost advantage, supported by its lean structure and efficient C2M model, are set to grow as it scales, both domestically and internationally. Its cross-border e-commerce platform, Temu, launched in September 2022, has rapidly become one of the world’s fastest-growing apps. Leveraging China’s excess capacity and PDD’s supply-chain efficiency, Temu wields strong pricing power over Chinese suppliers and attracts overseas consumers with competitively priced products. While still in early stage, Temu has achieved 2% of the global ex-China e-commerce market and a variable breakeven in the U.S. market, underscoring PDD’s focus on sustainable growth. Despite its rapid growth and profitability, PDD trades at a double-digit free cash flow yield (despite losses from the early-stage international expansion through Temu), significantly below sector peers. While concerns over geopolitical tensions exist, we believe PDD’s growing competitive edge, strong cash flow, and disciplined management position it to create substantial long-term value for shareholders.”

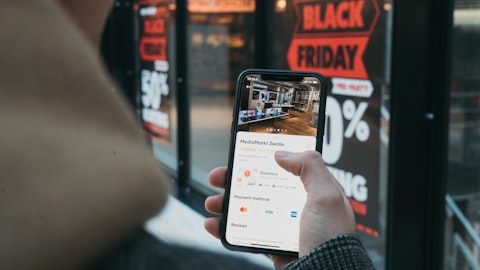

A close-up of a customer using the company’s e-commerce platform whilst shopping online.

PDD Holdings Inc. (NASDAQ:PDD) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 86 hedge fund portfolios held PDD Holdings Inc. (NASDAQ:PDD) at the end of the second quarter which was 76 in the previous quarter. In the second quarter, PDD Holdings Inc.’s (NASDAQ:PDD) revenue increased 86% year-over-year to RMB97.1 billion. While we acknowledge the potential of PDD Holdings Inc. (NASDAQ:PDD) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed PDD Holdings Inc. (NASDAQ:PDD) and shared the list of best consumer cyclical stocks to buy according to hedge funds. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.