Polen Capital, an investment management company, released its “Polen Focus Growth Strategy” third-quarter 2022 investor letter. A copy of the same can be downloaded here. The fund returned -5.47% net in the third quarter compared to -3.60% return for the Russell 1000 Growth Index and -4.88% return for the S&P 500 Index. Inflation and interest rate hikes caused a decline in the fund’s performance in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2022.

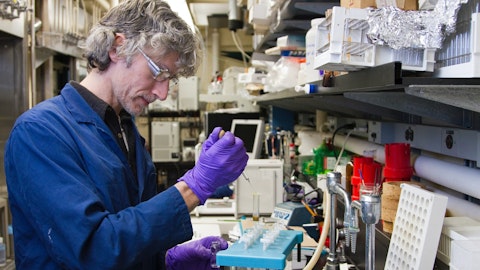

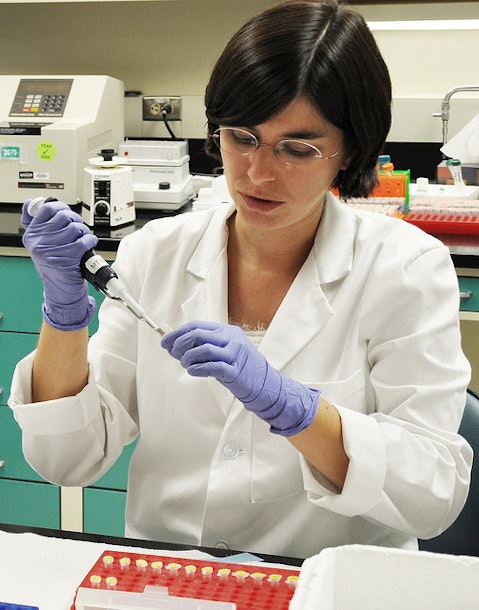

Polen Capital highlighted stocks like Illumina, Inc. (NASDAQ:ILMN) in its Q3 2022 investor letter. Headquartered in San Diego, California, Illumina, Inc. (NASDAQ:ILMN) is a biotechnology company. On October 20, 2022, Illumina, Inc. (NASDAQ:ILMN) stock closed at $208.64 per share. One-month return of Illumina, Inc. (NASDAQ:ILMN) was 7.83% and its shares lost 49.31% of their value over the last 52 weeks. Illumina, Inc. (NASDAQ:ILMN) has a market capitalization of $32.819 billion.

Polen Capital made the following comment about Illumina, Inc. (NASDAQ:ILMN) in its Q3 2022 investor letter:

“Illumina, Inc. (NASDAQ:ILMN) has had a very difficult year on what we believe are transitory issues. First, the company closed its acquisition of Grail, a startup early-stage cancer testing business it re-acquired (Grail was founded inside Illumina originally) for $8 billion without regulatory approval. Illumina management believes that European regulators have no jurisdiction over the transaction as Grail had no European presence or revenue and member states did not complain within the timeframe specified in applicable regulations. The regulators have challenged these assertions and are likely to try to require Illumina to divest Grail subject to Illumina’s appeal. In the meantime, Grail has already been very dilutive to Illumina’s earnings, and Illumina may have to sell the asset at the end of it all. It is unknown how much Grail could be sold for in this environment if Illumina is forced to divest.

Second, Illumina’s core sequencing business has also slowed. This is not unusual as the business has always been a bit lumpy, but there are new competitors trying to prove that they can sequence genomes cheaper than Illumina without sacrificing accuracy. Our research here suggests: 1) competitor technologies do not seem to be as cost-effective or accurate in the real world as advertised, providing limited risk to Illumina’s core business; 2) Illumina has unveiled its own next-generation technology, which lowers the cost of sequencing the human genome to only $200, including data processing costs with world-class accuracy; 3) the slowdown in the core business is more macroeconomic as customers are looking to reduce consumables inventory levels in tough times and should pass quite quickly considering customers are continuing to use their sequencers at high levels; and 4) even if Illumina were forced to divest Grail, we think they would likely be able to sell it for above what it purchased it for as all of the clinical data on the company’s Galleri cancer screen is now publicly available (it is very positive in our view). Grail has made significant commercial progress since its acquisition, and the company should only be closer to U.S. regulatory approval. We believe we can buy the shares today at an extremely cheap valuation for the core business of a company that we view as having an unmatched position in a market that should be multiples of its current size in the years to come.”

Illumina, Inc. (NASDAQ:ILMN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 44 hedge fund portfolios held Illumina, Inc. (NASDAQ:ILMN) at the end of the second quarter, which was 54 in the previous quarter.

We discussed Illumina, Inc. (NASDAQ:ILMN) in another article and shared Harding Loevner’ views on the company. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Top 10 Stock Exchanges In the World

- 11 Best Machine Learning Stocks To Buy

- 15 Best Drug Stocks To Buy

Disclosure: None. This article is originally published at Insider Monkey.