Heartland Advisors, an investment management company, released its “Heartland Value Fund” second quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, the Value Investor Class of the fund returned 3.14% and the Value Institutional Class returned 3.18% compared to 3.18% for the Russell 2000 Value Index. Although the fund performed in line with the benchmark, it lagged in the tech-heavy broader markets. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

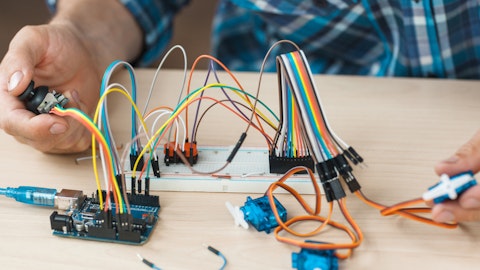

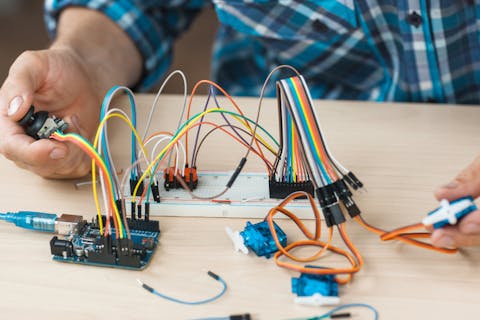

Heartland Value Fund highlighted stocks like Benchmark Electronics, Inc. (NYSE:BHE) in the Q2 2023 investor letter. Headquartered in Tempe, Arizona, Benchmark Electronics, Inc. (NYSE:BHE) provides product design, engineering services, technology solutions, and manufacturing services. On July 12, 2023, Benchmark Electronics, Inc. (NYSE:BHE) stock closed at $26.47 per share. One-month return of Benchmark Electronics, Inc. (NYSE:BHE) was 4.75%, and its shares gained 18.70% of their value over the last 52 weeks. Benchmark Electronics, Inc. (NYSE:BHE) has a market capitalization of $945.458 billion.

Heartland Value Fund made the following comment about Benchmark Electronics, Inc. (NYSE:BHE) in its second quarter 2023 investor letter:

“Technology. Electronic manufacturing services companies, like Benchmark Electronics, Inc. (NYSE:BHE), tend to do well in terms of profit and sales growth when times are good but poorly when times are bad, owing in part to their significant fixed cost overhead.

Though management has shifted its production mix away from lower-margin and slower-growth segments (like advanced computing) and toward higher-margin and faster-growth areas (like semi-cap equipment), BHE’s margins failed to deliver during the recent downturn in the semiconductor cycle. Moreover, recent moves to expand capacity to help customers “re-shore” manufacturing were not fully scaled, further weighing on margins. This short-term disappointment caused the stock to sell-off sharply and approach our downside target, creating a compelling entry point.

We believe management has now positioned the business in segments that will allow for above-average industry growth and margin expansion. BHE trades at 12 times 2023 earnings and 10 times 2024 profits. By comparison, industry peers with similar growth and margin expansion opportunities are trading at P/E ratios (based on 2024 earnings) in the low- to mid-teens.”

Golubovy/Shutterstock.com

Benchmark Electronics, Inc. (NYSE:BHE) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 18 hedge fund portfolios held Benchmark Electronics, Inc. (NYSE:BHE) at the end of first quarter which was 21 in the previous quarter.

We discussed Benchmark Electronics, Inc. (NYSE:BHE) in another article and shared the list of best emerging tech stocks to buy. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 11 Best Lithium Stocks To Buy Now

- 10 Best Stocks to Buy for a Month

- 11 Best Local Bank Stocks to Buy

Disclosure: None. This article is originally published at Insider Monkey.