The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at China Telecom Corporation Limited (NYSE:CHA) from the perspective of those elite funds.

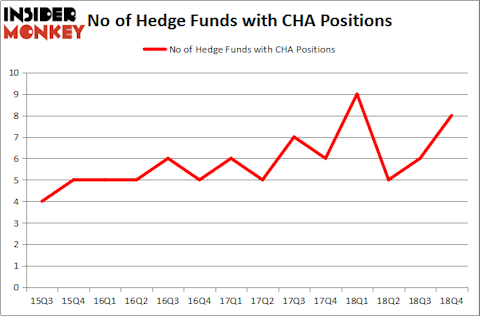

Is China Telecom Corporation Limited (NYSE:CHA) a worthy investment now? The best stock pickers are in a bullish mood. The number of bullish hedge fund positions improved by 2 lately. Our calculations also showed that CHA isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are assumed to be worthless, old investment tools of the past. While there are more than 8000 funds with their doors open at present, Our experts choose to focus on the bigwigs of this group, around 750 funds. These investment experts watch over the lion’s share of the smart money’s total capital, and by shadowing their first-class stock picks, Insider Monkey has identified a number of investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

What does the smart money think about China Telecom Corporation Limited (NYSE:CHA)?

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the second quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in CHA a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of China Telecom Corporation Limited (NYSE:CHA), with a stake worth $10 million reported as of the end of September. Trailing Renaissance Technologies was LMR Partners, which amassed a stake valued at $5.3 million. Arrowstreet Capital, Millennium Management, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers were leading the bulls’ herd. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, created the most valuable position in China Telecom Corporation Limited (NYSE:CHA). LMR Partners had $5.3 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to China Telecom Corporation Limited (NYSE:CHA). We will take a look at Las Vegas Sands Corp. (NYSE:LVS), Marathon Petroleum Corp (NYSE:MPC), Norfolk Southern Corp. (NYSE:NSC), and ABB Ltd (NYSE:ABB). This group of stocks’ market values match CHA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LVS | 44 | 1609562 | 6 |

| MPC | 72 | 3505650 | 6 |

| NSC | 47 | 1521287 | -2 |

| ABB | 13 | 265329 | 2 |

| Average | 44 | 1725457 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 44 hedge funds with bullish positions and the average amount invested in these stocks was $1725 million. That figure was $25 million in CHA’s case. Marathon Petroleum Corp (NYSE:MPC) is the most popular stock in this table. On the other hand ABB Ltd (NYSE:ABB) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks China Telecom Corporation Limited (NYSE:CHA) is even less popular than ABB. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately CHA wasn’t in this group. Hedge funds that bet on CHA were disappointed as the stock returned 8.2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.