Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like ZIOPHARM Oncology Inc. (NASDAQ:ZIOP).

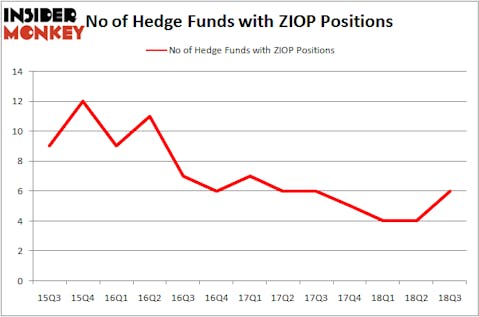

Is ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) worth your attention right now? Hedge funds are becoming hopeful. The number of bullish hedge fund positions increased by 2 lately. Our calculations also showed that ZIOP isn’t among the 30 most popular stocks among hedge funds. ZIOP was in 6 hedge funds’ portfolios at the end of September. There were 4 hedge funds in our database with ZIOP holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the key hedge fund action surrounding ZIOPHARM Oncology Inc. (NASDAQ:ZIOP).

What have hedge funds been doing with ZIOPHARM Oncology Inc. (NASDAQ:ZIOP)?

Heading into the fourth quarter of 2018, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in ZIOP heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) was held by MSDC Management, which reported holding $10.9 million worth of stock at the end of September. It was followed by D E Shaw with a $1.2 million position. Other investors bullish on the company included Citadel Investment Group, Citadel Investment Group, and Marshall Wace LLP.

Now, key hedge funds were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most outsized position in ZIOPHARM Oncology Inc. (NASDAQ:ZIOP). Marshall Wace LLP had $0.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to ZIOPHARM Oncology Inc. (NASDAQ:ZIOP). We will take a look at Anworth Mortgage Asset Corporation (NYSE:ANH), Gogo Inc (NASDAQ:GOGO), Rosetta Stone Inc (NYSE:RST), and Del Taco Restaurants Inc (NASDAQ:TACO). This group of stocks’ market caps resemble ZIOP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANH | 6 | 29694 | -3 |

| GOGO | 15 | 124336 | 3 |

| RST | 15 | 105326 | 1 |

| TACO | 13 | 53313 | -2 |

| Average | 12.25 | 78167 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $13 million in ZIOP’s case. Gogo Inc (NASDAQ:GOGO) is the most popular stock in this table. On the other hand Anworth Mortgage Asset Corporation (NYSE:ANH) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) is even less popular than ANH. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.