While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Yamana Gold Inc. (NYSE:AUY).

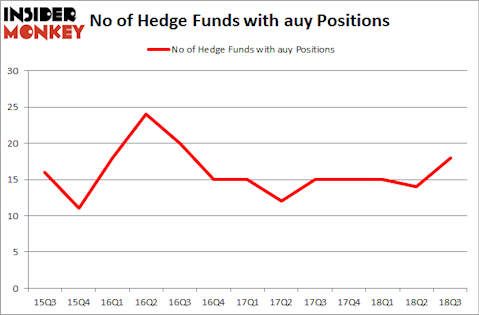

Yamana Gold Inc. (NYSE:AUY) has experienced an increase in hedge fund interest lately. AUY was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with AUY positions at the end of the previous quarter. Our calculations also showed that auy isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the recent hedge fund action surrounding Yamana Gold Inc. (NYSE:AUY).

How are hedge funds trading Yamana Gold Inc. (NYSE:AUY)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. By comparison, 15 hedge funds held shares or bullish call options in AUY heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Yamana Gold Inc. (NYSE:AUY), with a stake worth $26.6 million reported as of the end of September. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $10.9 million. Millennium Management, Prince Street Capital Management, and Lonestar Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, specific money managers have jumped into Yamana Gold Inc. (NYSE:AUY) headfirst. Adage Capital Management, managed by Phill Gross and Robert Atchinson, established the most valuable position in Yamana Gold Inc. (NYSE:AUY). Adage Capital Management had $2.5 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.6 million investment in the stock during the quarter. The following funds were also among the new AUY investors: Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s go over hedge fund activity in other stocks similar to Yamana Gold Inc. (NYSE:AUY). We will take a look at Anixter International Inc. (NYSE:AXE), California Resources Corporation (NYSE:CRC), Cal-Maine Foods Inc (NASDAQ:CALM), and Yext, Inc. (NYSE:YEXT). This group of stocks’ market valuations match AUY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXE | 17 | 318658 | 2 |

| CRC | 22 | 414123 | -1 |

| CALM | 21 | 190329 | 1 |

| YEXT | 16 | 203971 | 2 |

| Average | 19 | 281770 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $84 million in AUY’s case. California Resources Corporation (NYSE:CRC) is the most popular stock in this table. On the other hand Yext, Inc. (NYSE:YEXT) is the least popular one with only 16 bullish hedge fund positions. Yamana Gold Inc. (NYSE:AUY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CRC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.