The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Westlake Chemical Corporation (NYSE:WLK).

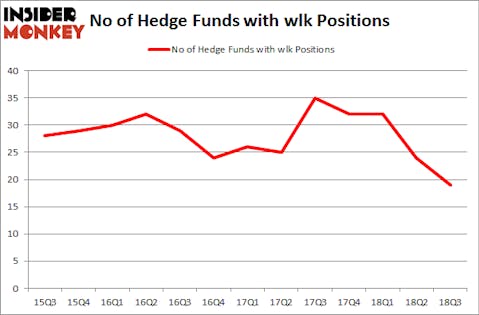

Westlake Chemical Corporation (NYSE:WLK) was in 19 hedge funds’ portfolios at the end of September. WLK shareholders have witnessed a decrease in activity from the world’s largest hedge funds in recent months. There were 24 hedge funds in our database with WLK holdings at the end of the previous quarter. Our calculations also showed that wlk isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to analyze the recent hedge fund action surrounding Westlake Chemical Corporation (NYSE:WLK).

What does the smart money think about Westlake Chemical Corporation (NYSE:WLK)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards WLK over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Westlake Chemical Corporation (NYSE:WLK) was held by AQR Capital Management, which reported holding $166.9 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $47.9 million position. Other investors bullish on the company included Millennium Management, Royce & Associates, and Luminus Management.

Due to the fact that Westlake Chemical Corporation (NYSE:WLK) has faced falling interest from the entirety of the hedge funds we track, we can see that there was a specific group of hedge funds that slashed their full holdings by the end of the third quarter. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the biggest stake of the 700 funds tracked by Insider Monkey, comprising about $57.8 million in stock. Nick Niell’s fund, Arrowgrass Capital Partners, also cut its stock, about $9.1 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 5 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Westlake Chemical Corporation (NYSE:WLK). These stocks are PerkinElmer, Inc. (NYSE:PKI), Cboe Global Markets, Inc. (BATS:CBOE), Sarepta Therapeutics Inc (NASDAQ:SRPT), and Macy’s, Inc. (NYSE:M). All of these stocks’ market caps resemble WLK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PKI | 23 | 1117448 | 1 |

| CBOE | 21 | 804776 | -6 |

| SRPT | 43 | 1213313 | -4 |

| M | 29 | 573651 | 5 |

| Average | 29 | 927297 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $927 million. That figure was $327 million in WLK’s case. Sarepta Therapeutics Inc (NASDAQ:SRPT) is the most popular stock in this table. On the other hand Cboe Global Markets, Inc. (BATS:CBOE) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Westlake Chemical Corporation (NYSE:WLK) is even less popular than CBOE. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.