It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Unilever N.V. (ADR) (NYSE:UN) .

Hedge fund interest in Unilever N.V. (ADR) (NYSE:UN) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare UN to other stocks including Citigroup Inc. (NYSE:C), UnitedHealth Group Inc. (NYSE:UNH), and Amgen, Inc. (NASDAQ:AMGN) to get a better sense of its popularity.

Follow Unilever N V (NYSE:UN)

Follow Unilever N V (NYSE:UN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Rawpixel / shutterstock.com

Now, let’s view the new action encompassing Unilever N.V. (ADR) (NYSE:UN).

How have hedgies been trading Unilever N.V. (ADR) (NYSE:UN)?

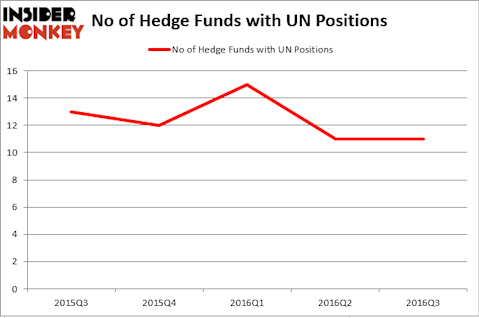

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in UN heading into this year. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Gardner Russo & Gardner, led by Tom Russo, holds the most valuable position in Unilever N.V. (ADR) (NYSE:UN). Gardner Russo & Gardner has a $660.3 million position in the stock, comprising 5.5% of its 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $145.7 million position; 0.5% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism consist of Donald Yacktman’s Yacktman Asset Management, Scott Wallace’s Wallace Capital Management and D E Shaw, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Unilever N.V. (ADR) (NYSE:UN) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of funds who sold off their positions entirely last quarter. Interestingly, David Costen Haley’s HBK Investments dumped the largest stake of all the hedgies watched by Insider Monkey, valued at an estimated $3.3 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also dumped its stock, about $1.1 million worth.

Let’s check out hedge fund activity in other stocks similar to Unilever N.V. (ADR) (NYSE:UN). These stocks are Citigroup Inc. (NYSE:C), UnitedHealth Group Inc. (NYSE:UNH), Amgen, Inc. (NASDAQ:AMGN), and Altria Group Inc (NYSE:MO). All of these stocks’ market caps match UN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| C | 97 | 8707804 | 0 |

| UNH | 52 | 2703217 | -3 |

| AMGN | 59 | 1863803 | 1 |

| MO | 40 | 1770652 | -6 |

As you can see these stocks had an average of 62 hedge funds with bullish positions and the average amount invested in these stocks was $3761 million. That figure was $954 million in UN’s case. Citigroup Inc. (NYSE:C) is the most popular stock in this table. On the other hand Altria Group Inc (NYSE:MO) is the least popular one with only 40 bullish hedge fund positions. Compared to these stocks Unilever N.V. (ADR) (NYSE:UN) is even less popular than MO. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Best Summer Jobs For Teachers

Countries That Make The Best Music

Biggest Outlet Malls In USA

Disclosure: None