The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Tabula Rasa HealthCare Inc (NASDAQ:TRHC) from the perspective of those successful funds.

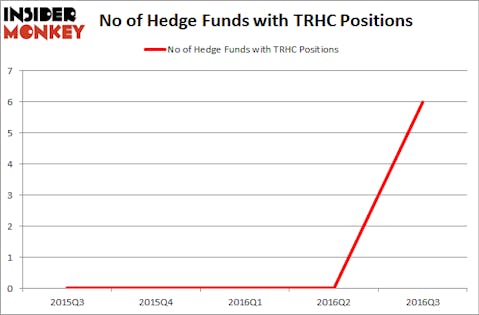

Is Tabula Rasa HealthCare Inc (NASDAQ:TRHC) a buy here? Prominent investors are undoubtedly taking an optimistic view. The number of long hedge fund investments rose by 6 in recent months. At the end of this article we will also compare TRHC to other stocks including Hill International Inc (NYSE:HIL), Exa Corp (NASDAQ:EXA), and KongZhong Corporation(ADR) (NASDAQ:KZ) to get a better sense of its popularity.

Follow Tabula Rasa Healthcare Inc. (NASDAQ:TRHC)

Follow Tabula Rasa Healthcare Inc. (NASDAQ:TRHC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Wichy/Shutterstock.com

Keeping this in mind, let’s review the latest action regarding Tabula Rasa HealthCare Inc (NASDAQ:TRHC).

How are hedge funds trading Tabula Rasa HealthCare Inc (NASDAQ:TRHC)?

Tabula Rasa HealthCare Inc (NASDAQ:TRHC) went public at the end of September and a total of 6 hedge funds amassed shares of the company heading into the fourth quarter. Below, you can check out the change in hedge fund sentiment towards TRHC over the last 5 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Michael Castor’s Sio Capital has the number one position in Tabula Rasa HealthCare Inc (NASDAQ:TRHC), worth close to $7.3 million, accounting for 5% of its total 13F portfolio. On Sio Capital’s heels is Millennium Management, one of the largest hedge funds in the world, holding a $3 million position. Some other professional money managers that are bullish consist of Richard Driehaus’ Driehaus Capital, Brian Taylor’s Pine River Capital Management and Paul Marshall and Ian Wace’s Marshall Wace LLP. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.