Does Sherwin-Williams Co (NYSE:SHW) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund sentiment towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

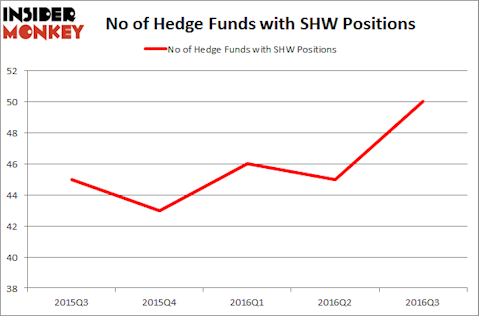

Sherwin-Williams Co (NYSE:SHW) was in 50 hedge funds’ portfolios at the end of the third quarter of 2016. SHW investors should pay attention to an increase in hedge fund interest of late. There were 45 hedge funds in our database with SHW holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as LIBERTY GLOBAL PLC (NASDAQ:LBTYK), Manulife Financial Corporation (USA) (NYSE:MFC), and Equinix Inc (NASDAQ:EQIX) to gather more data points.

Follow Sherwin Williams Co (NYSE:SHW)

Follow Sherwin Williams Co (NYSE:SHW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

Now, let’s take a look at the new action surrounding Sherwin-Williams Co (NYSE:SHW).

Hedge fund activity in Sherwin-Williams Co (NYSE:SHW)

At Q3’s end, a total of 50 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the previous quarter. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Dan Loeb’s Third Point has the most valuable position in Sherwin-Williams Co (NYSE:SHW), worth close to $242.1 million, amounting to 2.1% of its total 13F portfolio. Sitting at the No. 2 spot is Eric Mindich of Eton Park Capital, with a $220.1 million position; the fund has 3.8% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of James Crichton’s Hitchwood Capital Management, Robert Joseph Caruso’s Select Equity Group and Richard Chilton’s Chilton Investment Company.