Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

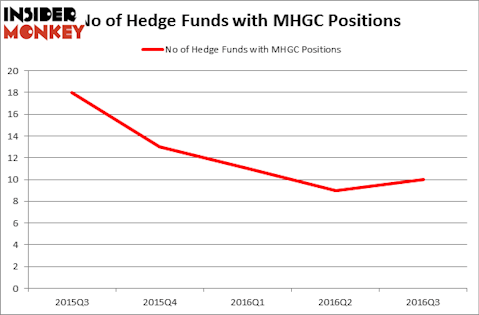

Is Morgans Hotel Group Co. (NASDAQ:MHGC) a buy, sell, or hold? The smart money is altogether taking an optimistic view. The number of long hedge fund bets that are revealed through the 13F filings inched up by 1 lately. There were 9 hedge funds in our database with MHGC holdings at the end of the previous quarter. At the end of this article we will also compare MHGC to other stocks including Bravo Brio Restaurant Group, Inc. (NASDAQ:BBRG), Key Technology, Inc. (NASDAQ:KTEC), and UCP Inc (NYSE:UCP) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Paul Cowan / Shutterstock.com

With all of this in mind, let’s analyze the key action surrounding Morgans Hotel Group Co. (NASDAQ:MHGC).

How have hedgies been trading Morgans Hotel Group Co. (NASDAQ:MHGC)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the second quarter of 2016. By comparison, 13 hedge funds held shares or bullish call options in MHGC heading into this year. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Brian Taylor’s Pine River Capital Management has the number one position in Morgans Hotel Group Co. (NASDAQ:MHGC), worth close to $6.3 million. Coming in second is Gordy Holterman and Derek Dunn of Overland Advisors which holds a $2.5 million position. Remaining peers that are bullish comprise Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world, Mario Gabelli’s GAMCO Investors and Israel Englander’s Millennium Management. We should note that none of these elite funds are among our list of the 100 best performing elite funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Vishal Bhutani and Joshua Bederman of Pyrrho Capital Management established the most valuable position in Morgans Hotel Group Co. (NASDAQ:MHGC). Pyrrho Capital Management had $0.1 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $0.1 million position during the quarter. The only other fund with a brand new MHGC position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Morgans Hotel Group Co. (NASDAQ:MHGC). These stocks are Bravo Brio Restaurant Group, Inc. (NASDAQ:BBRG), Key Technology, Inc. (NASDAQ:KTEC), UCP Inc (NYSE:UCP), and Sophiris Bio Inc (NASDAQ:SPHS). This group of stocks’ market caps are similar to MHGC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBRG | 8 | 3022 | -3 |

| KTEC | 6 | 17926 | 1 |

| UCP | 5 | 14060 | 0 |

| SPHS | 5 | 3361 | 2 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $11 million in MHGC’s case. Bravo Brio Restaurant Group, Inc. (NASDAQ:BBRG) is the most popular stock in this table. On the other hand UCP Inc (NYSE:UCP) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Morgans Hotel Group Co. (NASDAQ:MHGC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None