We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Michael Kors Holdings Ltd (NYSE:KORS).

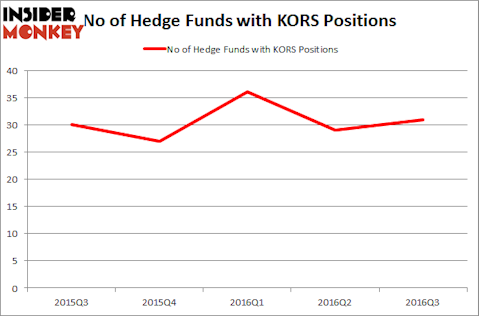

Is Michael Kors Holdings Ltd (NYSE:KORS) a great investment right now? Hedge funds are getting more optimistic. The number of long hedge fund bets increased by 2 lately. At the end of this article we will also compare KORS to other stocks including Amdocs Limited (NYSE:DOX), Cemex SAB de CV (ADR) (NYSE:CX), and Juniper Networks, Inc. (NYSE:JNPR) to get a better sense of its popularity.

Follow Capri Holdings Ltd (NYSE:CPRI)

Follow Capri Holdings Ltd (NYSE:CPRI)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

August_0802 / Shutterstock.com

Now, we’re going to take a look at the new action surrounding Michael Kors Holdings Ltd (NYSE:KORS).

How are hedge funds trading Michael Kors Holdings Ltd (NYSE:KORS)?

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a modest increase of 7% from the second quarter of 2016. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the largest position in Michael Kors Holdings Ltd (NYSE:KORS). The fund has a $182.4 million position in the stock, comprising 0.3% of its 13F portfolio. On AQR Capital Management’s heels is Greenlight Capital, managed by David Einhorn, which holds a $143.5 million position; 2.7% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish encompass Kamyar Khajavi’s MIK Capital, Jim Simons’s Renaissance Technologies and Joel Greenblatt’s Gotham Asset Management.