We can judge whether Methanex Corporation (NASDAQ:MEOH) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

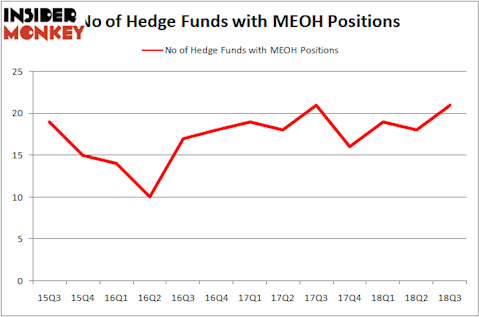

Methanex Corporation (NASDAQ:MEOH) has experienced an increase in enthusiasm from smart money of late. MEOH was in 21 hedge funds’ portfolios at the end of the third quarter of 2018. There were 18 hedge funds in our database with MEOH holdings at the end of the previous quarter. Our calculations also showed that MEOH isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a multitude of indicators market participants have at their disposal to grade their stock investments. A couple of the less known indicators are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outpace the broader indices by a significant amount (see the details here).

Cliff Asness of AQR Capital Management

We’re going to take a gander at the latest hedge fund action regarding Methanex Corporation (NASDAQ:MEOH).

How have hedgies been trading Methanex Corporation (NASDAQ:MEOH)?

Heading into the fourth quarter of 2018, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the second quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in MEOH heading into this year. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of Methanex Corporation (NASDAQ:MEOH), with a stake worth $160 million reported as of the end of September. Trailing AQR Capital Management was Two Sigma Advisors, which amassed a stake valued at $20.8 million. Citadel Investment Group, Renaissance Technologies, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, specific money managers have jumped into Methanex Corporation (NASDAQ:MEOH) headfirst. Citadel Investment Group, managed by Ken Griffin, established the largest position in Methanex Corporation (NASDAQ:MEOH). Citadel Investment Group had $20.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $1.5 million investment in the stock during the quarter. The only other fund with a brand new MEOH position is David Andre and Astro Teller’s Cerebellum Capital.

Let’s now review hedge fund activity in other stocks similar to Methanex Corporation (NASDAQ:MEOH). We will take a look at BWX Technologies Inc (NYSE:BWXT), WABCO Holdings Inc. (NYSE:WBC), Eaton Vance Corp (NYSE:EV), and LG Display Co Ltd. (NYSE:LPL). This group of stocks’ market valuations match MEOH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BWXT | 17 | 205166 | -6 |

| WBC | 15 | 590018 | -8 |

| EV | 15 | 148925 | 0 |

| LPL | 6 | 27533 | -3 |

| Average | 13.25 | 242911 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $243 million. That figure was $301 million in MEOH’s case. BWX Technologies Inc (NYSE:BWXT) is the most popular stock in this table. On the other hand LG Display Co Ltd. (NYSE:LPL) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Methanex Corporation (NASDAQ:MEOH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.