During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of MB Financial, Inc. (NASDAQ:MBFI) and see how the stock is affected by the recent hedge fund activity.

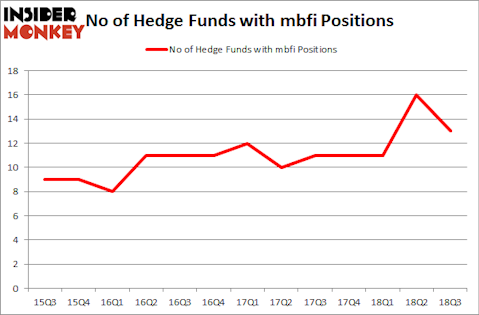

Is MB Financial, Inc. (NASDAQ:MBFI) a superb investment today? The best stock pickers are taking a bearish view. The number of bullish hedge fund positions shrunk by 3 in recent months. Our calculations also showed that mbfi isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are assumed to be underperforming, old investment vehicles of years past. While there are greater than 8,000 funds with their doors open at the moment, Our researchers choose to focus on the leaders of this club, approximately 700 funds. Most estimates calculate that this group of people control the lion’s share of the smart money’s total asset base, and by observing their top stock picks, Insider Monkey has formulated various investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the key hedge fund action surrounding MB Financial, Inc. (NASDAQ:MBFI).

What does the smart money think about MB Financial, Inc. (NASDAQ:MBFI)?

Heading into the fourth quarter of 2018, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MBFI over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in MB Financial, Inc. (NASDAQ:MBFI) was held by Magnetar Capital, which reported holding $68.6 million worth of stock at the end of September. It was followed by Water Island Capital with a $59.4 million position. Other investors bullish on the company included Cardinal Capital, Alpine Associates, and Arrowstreet Capital.

Seeing as MB Financial, Inc. (NASDAQ:MBFI) has witnessed declining sentiment from the smart money, logic holds that there lies a certain “tier” of hedge funds who sold off their full holdings by the end of the third quarter. Intriguingly, John W. Rogers’s Ariel Investments dropped the biggest investment of all the hedgies watched by Insider Monkey, worth close to $5.9 million in stock, and Daniel Arbess’s Perella Weinberg Partners was right behind this move, as the fund said goodbye to about $2.4 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as MB Financial, Inc. (NASDAQ:MBFI) but similarly valued. These stocks are Ryder System, Inc. (NYSE:R), Southwest Gas Holdings, Inc. (NYSE:SWX), Taro Pharmaceutical Industries Ltd. (NYSE:TARO), and Plains GP Holdings LP (NYSE:PAGP). All of these stocks’ market caps match MBFI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| R | 23 | 383351 | 6 |

| SWX | 13 | 177582 | 0 |

| TARO | 14 | 70986 | 5 |

| PAGP | 23 | 407954 | -1 |

| Average | 18.25 | 259968 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $260 million. That figure was $238 million in MBFI’s case. Ryder System, Inc. (NYSE:R) is the most popular stock in this table. On the other hand Southwest Gas Holdings, Inc. (NYSE:SWX) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks MB Financial, Inc. (NASDAQ:MBFI) is even less popular than SWX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.