After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards LiveRamp Holdings, Inc. (NYSE:RAMP).

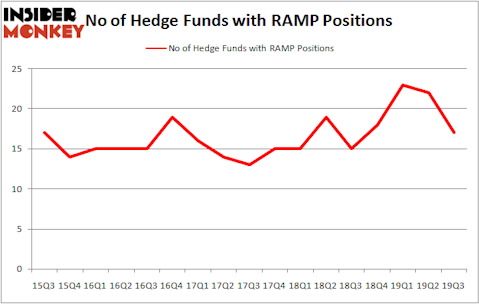

Is LiveRamp Holdings, Inc. (NYSE:RAMP) undervalued? The best stock pickers are becoming less hopeful. The number of long hedge fund bets decreased by 5 lately. Our calculations also showed that RAMP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most shareholders, hedge funds are seen as slow, outdated financial vehicles of years past. While there are more than 8000 funds with their doors open today, Our researchers look at the moguls of this group, approximately 750 funds. Most estimates calculate that this group of people oversee the majority of the hedge fund industry’s total capital, and by monitoring their matchless stock picks, Insider Monkey has found a number of investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the new hedge fund action encompassing LiveRamp Holdings, Inc. (NYSE:RAMP).

What have hedge funds been doing with LiveRamp Holdings, Inc. (NYSE:RAMP)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RAMP over the last 17 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Abrams Bison Investments held the most valuable stake in LiveRamp Holdings, Inc. (NYSE:RAMP), which was worth $86.8 million at the end of the third quarter. On the second spot was RGM Capital which amassed $78.2 million worth of shares. Renaissance Technologies, Ancora Advisors, and Potrero Capital Research were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to LiveRamp Holdings, Inc. (NYSE:RAMP), around 8.67% of its 13F portfolio. RGM Capital is also relatively very bullish on the stock, setting aside 5.2 percent of its 13F equity portfolio to RAMP.

Judging by the fact that LiveRamp Holdings, Inc. (NYSE:RAMP) has faced falling interest from hedge fund managers, it’s easy to see that there is a sect of hedgies who were dropping their entire stakes by the end of the third quarter. Intriguingly, Principal Global Investors’s Columbus Circle Investors cut the biggest stake of the “upper crust” of funds followed by Insider Monkey, worth an estimated $15.5 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund dropped about $15 million worth. These transactions are important to note, as total hedge fund interest was cut by 5 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as LiveRamp Holdings, Inc. (NYSE:RAMP) but similarly valued. We will take a look at Global Blood Therapeutics Inc (NASDAQ:GBT), International Game Technology PLC (NYSE:IGT), TC Pipelines, LP (NYSE:TCP), and Advanced Disposal Services, Inc. (NYSE:ADSW). All of these stocks’ market caps match RAMP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBT | 24 | 543271 | -6 |

| IGT | 27 | 234121 | -3 |

| TCP | 5 | 17286 | 0 |

| ADSW | 24 | 668160 | -2 |

| Average | 20 | 365710 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $366 million. That figure was $199 million in RAMP’s case. International Game Technology PLC (NYSE:IGT) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 5 bullish hedge fund positions. LiveRamp Holdings, Inc. (NYSE:RAMP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on RAMP as the stock returned 16.6% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.