Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Laureate Education, Inc. (NASDAQ:LAUR).

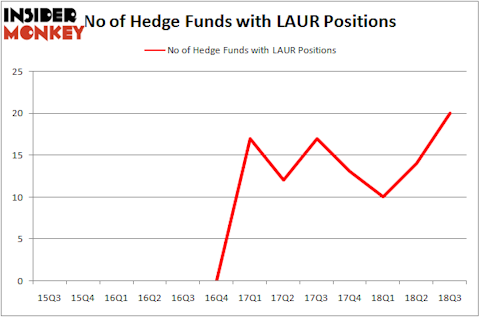

Is Laureate Education, Inc. (NASDAQ:LAUR) undervalued? The smart money is taking an optimistic view. The number of long hedge fund bets inched up by 6 recently. Our calculations also showed that LAUR isn’t among the 30 most popular stocks among hedge funds. LAUR was in 20 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with LAUR positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the recent hedge fund action regarding Laureate Education, Inc. (NASDAQ:LAUR).

What have hedge funds been doing with Laureate Education, Inc. (NASDAQ:LAUR)?

At Q3’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 43% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in LAUR heading into this year. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Melvin Capital Management was the largest shareholder of Laureate Education, Inc. (NASDAQ:LAUR), with a stake worth $80.3 million reported as of the end of September. Trailing Melvin Capital Management was 12 West Capital Management, which amassed a stake valued at $78.5 million. Ailanthus Capital Management, Park West Asset Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were breaking ground themselves. Park West Asset Management, managed by Peter S. Park, assembled the largest position in Laureate Education, Inc. (NASDAQ:LAUR). Park West Asset Management had $13.6 million invested in the company at the end of the quarter. David Halpert’s Prince Street Capital Management also made a $3.5 million investment in the stock during the quarter. The following funds were also among the new LAUR investors: D. E. Shaw’s D E Shaw, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s also examine hedge fund activity in other stocks similar to Laureate Education, Inc. (NASDAQ:LAUR). These stocks are Helen of Troy Limited (NASDAQ:HELE), Spirit Realty Capital Inc (NYSE:SRC), Zynga Inc (NASDAQ:ZNGA), and Blueprint Medicines Corporation (NASDAQ:BPMC). All of these stocks’ market caps match LAUR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HELE | 12 | 155994 | -2 |

| SRC | 21 | 465528 | -8 |

| ZNGA | 26 | 614239 | 3 |

| BPMC | 27 | 614433 | 3 |

| Average | 21.5 | 462549 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $463 million. That figure was $233 million in LAUR’s case. Blueprint Medicines Corporation (NASDAQ:BPMC) is the most popular stock in this table. On the other hand Helen of Troy Limited (NASDAQ:HELE) is the least popular one with only 12 bullish hedge fund positions. Laureate Education, Inc. (NASDAQ:LAUR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BPMC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.