Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Korea Electric Power Corporation (NYSE:KEP).

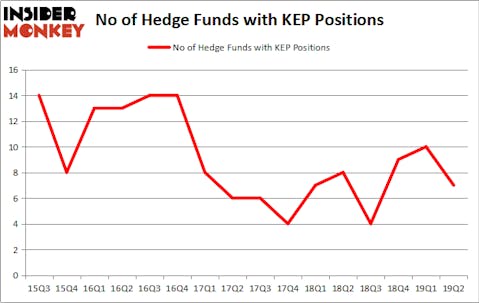

Is Korea Electric Power Corporation (NYSE:KEP) ready to rally soon? Prominent investors are in a pessimistic mood. The number of bullish hedge fund positions fell by 3 recently. Our calculations also showed that KEP isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the key hedge fund action surrounding Korea Electric Power Corporation (NYSE:KEP).

How are hedge funds trading Korea Electric Power Corporation (NYSE:KEP)?

At the end of the second quarter, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of -30% from the previous quarter. By comparison, 8 hedge funds held shares or bullish call options in KEP a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Korea Electric Power Corporation (NYSE:KEP) was held by Kopernik Global Investors, which reported holding $23.5 million worth of stock at the end of March. It was followed by Orbis Investment Management with a $19.1 million position. Other investors bullish on the company included D E Shaw, Citadel Investment Group, and ExodusPoint Capital.

Because Korea Electric Power Corporation (NYSE:KEP) has faced bearish sentiment from the smart money, it’s easy to see that there was a specific group of money managers that decided to sell off their positions entirely in the second quarter. At the top of the heap, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners said goodbye to the largest investment of the 750 funds tracked by Insider Monkey, valued at an estimated $8.6 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund cut about $7.1 million worth. These moves are interesting, as total hedge fund interest fell by 3 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to Korea Electric Power Corporation (NYSE:KEP). These stocks are CrowdStrike Holdings, Inc. (NASDAQ:CRWD), Skyworks Solutions Inc (NASDAQ:SWKS), Brookfield Property REIT Inc. (NASDAQ:BPR), and CNH Industrial NV (NYSE:CNHI). This group of stocks’ market values match KEP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRWD | 41 | 343926 | 41 |

| SWKS | 31 | 734317 | -7 |

| BPR | 16 | 62007 | 1 |

| CNHI | 14 | 353927 | -9 |

| Average | 25.5 | 373544 | 6.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $374 million. That figure was $44 million in KEP’s case. CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is the most popular stock in this table. On the other hand CNH Industrial NV (NYSE:CNHI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Korea Electric Power Corporation (NYSE:KEP) is even less popular than CNHI. Hedge funds dodged a bullet by taking a bearish stance towards KEP. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately KEP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); KEP investors were disappointed as the stock returned -2.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.