The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Karyopharm Therapeutics Inc (NASDAQ:KPTI) .

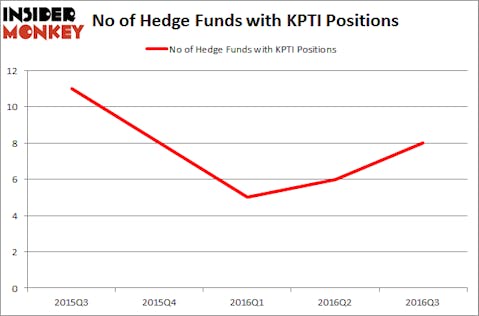

Karyopharm Therapeutics Inc (NASDAQ:KPTI) shareholders have witnessed an increase in hedge fund interest lately. There were 8 hedge funds in our database with KPTI positions at the end of September. At the end of this article we will also compare KPTI to other stocks including Bank Mutual Corporation (NASDAQ:BKMU), Corenergy Infrastructure Trust Inc (NYSE:CORR), and Digimarc Corp (NASDAQ:DMRC) to get a better sense of its popularity.

Follow Karyopharm Therapeutics Inc. (NASDAQ:KPTI)

Follow Karyopharm Therapeutics Inc. (NASDAQ:KPTI)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, let’s take a glance at the fresh action regarding Karyopharm Therapeutics Inc (NASDAQ:KPTI).

Hedge fund activity in Karyopharm Therapeutics Inc (NASDAQ:KPTI)

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a jump of 33% from the second quarter of 2016. By comparison, 8 hedge funds held shares or bullish call options in KPTI heading into this year. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Palo Alto Investors, led by William Leland Edwards, holds the largest position in Karyopharm Therapeutics Inc (NASDAQ:KPTI). According to regulatory filings, the fund has a $30 million position in the stock, comprising 1.7% of its 13F portfolio. The second most bullish fund manager is Millennium Management, one of the 10 largest hedge funds in the world, with an $8.5 million position; less than 0.1% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism consist of Julian Baker and Felix Baker’s Baker Bros. Advisors, Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Citadel Investment Group, led by Ken Griffin, created the biggest position in Karyopharm Therapeutics Inc (NASDAQ:KPTI). According to its latest 13F filing, the fund had $0.3 million invested in the company at the end of the quarter. David E. Shaw’s D E Shaw also initiated a $0.3 million position during the quarter. The following funds were also among the new KPTI investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks similar to Karyopharm Therapeutics Inc (NASDAQ:KPTI). We will take a look at Bank Mutual Corporation (NASDAQ:BKMU), Corenergy Infrastructure Trust Inc (NYSE:CORR), Digimarc Corp (NASDAQ:DMRC), and Protagonist Therapeutics Inc (NASDAQ:PTGX). This group of stocks’ market valuations are closest to KPTI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BKMU | 6 | 15669 | 0 |

| CORR | 7 | 38593 | 3 |

| DMRC | 6 | 38689 | 1 |

| PTGX | 5 | 76793 | 5 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was also $42 million in KPTI’s case. Corenergy Infrastructure Trust Inc (NYSE:CORR) is the most popular stock in this table. On the other hand Protagonist Therapeutics Inc (NASDAQ:PTGX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Karyopharm Therapeutics Inc (NASDAQ:KPTI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None