Is Franco Nevada Corporation (NYSE:FNV) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

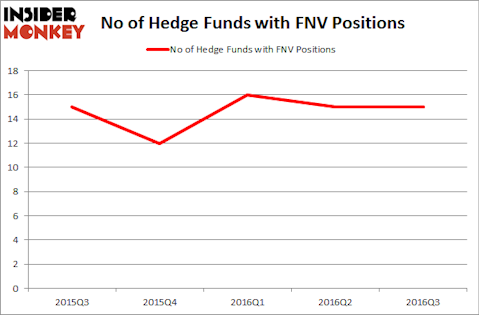

Franco Nevada Corporation (NYSE:FNV) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. There were 15 funds tracked by Insider Monkey bullish on the company at the end of September. At the end of this article we will also compare FNV to other stocks including Fifth Third Bancorp (NASDAQ:FITB), Lam Research Corporation (NASDAQ:LRCX), and EQT Corporation (NYSE:EQT) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sashkin/Shutterstock.com

Keeping this in mind, we’re going to review the key action regarding Franco-Nevada Corporation (NYSE:FNV).

Hedge fund activity in Franco-Nevada Corporation (NYSE:FNV)

At the end of September, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on Franco-Nevada Corporation, unchanged from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in FNV heading into 2016. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the most valuable position in Franco-Nevada Corporation (NYSE:FNV), worth close to $131.6 million. Sitting at the No. 2 spot is Odey Asset Management Group, led by Crispin Odey, holding a $75.4 million position; the fund has 5.4% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass Murray Stahl’s Horizon Asset Management, Chuck Royce’s Royce & Associates, and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.