Does Fluidigm Corporation (NASDAQ:FLDM) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

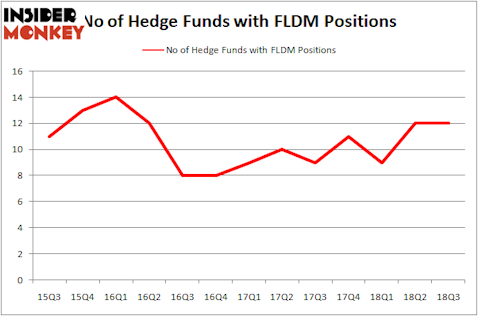

Fluidigm Corporation (NASDAQ:FLDM) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Reliant Bancorp, Inc. (NASDAQ:RBNC), BlueLinx Holdings Inc. (NYSE:BXC), and Industrea Acquisition Corp. (NASDAQ:INDU) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the latest hedge fund action regarding Fluidigm Corporation (NASDAQ:FLDM).

Hedge fund activity in Fluidigm Corporation (NASDAQ:FLDM)

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the second quarter of 2018. On the other hand, there were a total of 11 hedge funds with a bullish position in FLDM at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Levin Capital Strategies held the most valuable stake in Fluidigm Corporation (NASDAQ:FLDM), which was worth $76.4 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $8.6 million worth of shares. Moreover, OrbiMed Advisors, Endurant Capital Management, and Millennium Management were also bullish on Fluidigm Corporation (NASDAQ:FLDM), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: LMR Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Pura Vida Investments).

Let’s now review hedge fund activity in other stocks similar to Fluidigm Corporation (NASDAQ:FLDM). These stocks are Reliant Bancorp, Inc. (NASDAQ:RBNC), BlueLinx Holdings Inc. (NYSE:BXC), Industrea Acquisition Corp. (NASDAQ:INDU), and Navios Maritime Partners L.P. (NYSE:NMM). This group of stocks’ market valuations are closest to FLDM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBNC | 2 | 1074 | 1 |

| BXC | 12 | 50149 | 1 |

| INDU | 10 | 52266 | -1 |

| NMM | 5 | 6357 | 0 |

| Average | 7.25 | 27462 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $105 million in FLDM’s case. BlueLinx Holdings Inc. (NYSE:BXC) is the most popular stock in this table. On the other hand Reliant Bancorp, Inc. (NASDAQ:RBNC) is the least popular one with only 2 bullish hedge fund positions. Fluidigm Corporation (NASDAQ:FLDM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BXC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.