Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of Fair Isaac Corporation (NYSE:FICO) based on that data and determine whether they were really smart about the stock.

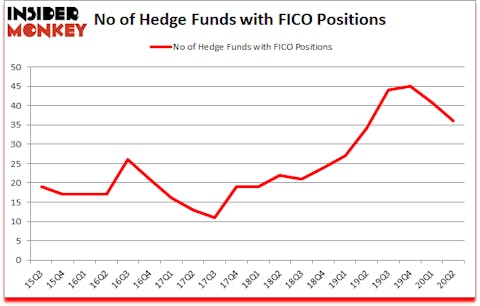

Is Fair Isaac Corporation (NYSE:FICO) going to take off soon? Investors who are in the know were in a pessimistic mood. The number of long hedge fund positions decreased by 5 recently. Fair Isaac Corporation (NYSE:FICO) was in 36 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 45. Our calculations also showed that FICO isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 41 hedge funds in our database with FICO holdings at the end of March.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are several metrics investors can use to size up their stock investments. A duo of the most useful metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best money managers can outpace the market by a very impressive margin (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, this “mom” trader turned $2000 into $2 million within 2 years. So, we are checking out her best trade idea of the month. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s review the latest hedge fund action encompassing Fair Isaac Corporation (NYSE:FICO).

What have hedge funds been doing with Fair Isaac Corporation (NYSE:FICO)?

At Q2’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -12% from the first quarter of 2020. On the other hand, there were a total of 34 hedge funds with a bullish position in FICO a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Melvin Capital Management was the largest shareholder of Fair Isaac Corporation (NYSE:FICO), with a stake worth $441.5 million reported as of the end of September. Trailing Melvin Capital Management was Ako Capital, which amassed a stake valued at $154.3 million. Valley Forge Capital, Broad Bay Capital, and Newbrook Capital Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Valley Forge Capital allocated the biggest weight to Fair Isaac Corporation (NYSE:FICO), around 17.29% of its 13F portfolio. Broad Bay Capital is also relatively very bullish on the stock, dishing out 12.89 percent of its 13F equity portfolio to FICO.

Judging by the fact that Fair Isaac Corporation (NYSE:FICO) has witnessed falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of money managers who were dropping their entire stakes in the second quarter. Intriguingly, Guy Shahar’s DSAM Partners dropped the largest stake of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $18.1 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also cut its stock, about $13.9 million worth. These moves are important to note, as total hedge fund interest was cut by 5 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to Fair Isaac Corporation (NYSE:FICO). These stocks are GDS Holdings Limited (NASDAQ:GDS), Brookfield Infrastructure Partners L.P. (NYSE:BIP), The J.M. Smucker Company (NYSE:SJM), W.P. Carey Inc. (NYSE:WPC), LINE Corporation (NYSE:LN), Catalent Inc (NYSE:CTLT), and NVR, Inc. (NYSE:NVR). This group of stocks’ market valuations match FICO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDS | 43 | 2239390 | 2 |

| BIP | 12 | 52792 | -2 |

| SJM | 38 | 673873 | 2 |

| WPC | 23 | 93673 | 1 |

| LN | 8 | 116785 | 1 |

| CTLT | 35 | 490420 | 8 |

| NVR | 39 | 939775 | 5 |

| Average | 28.3 | 658101 | 2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.3 hedge funds with bullish positions and the average amount invested in these stocks was $658 million. That figure was $1223 million in FICO’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand LINE Corporation (NYSE:LN) is the least popular one with only 8 bullish hedge fund positions. Fair Isaac Corporation (NYSE:FICO) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FICO is 64. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and beat the market by 23.2 percentage points. Unfortunately FICO wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on FICO were disappointed as the stock returned 0.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Fair Isaac Corp (NYSE:FICO)

Follow Fair Isaac Corp (NYSE:FICO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.