Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first half of 2019. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards EPAM Systems Inc (NYSE:EPAM) to find out whether it was one of their high conviction long-term ideas.

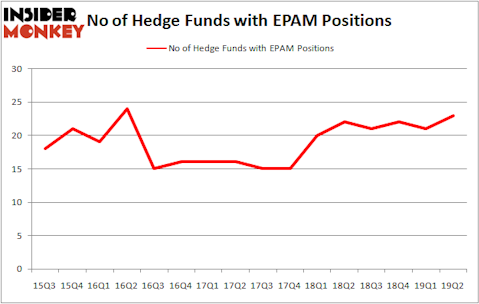

Is EPAM Systems Inc (NYSE:EPAM) a healthy stock for your portfolio? Prominent investors are buying. The number of long hedge fund positions went up by 2 in recent months. Our calculations also showed that EPAM isn’t among the 30 most popular stocks among hedge funds. EPAM was in 23 hedge funds’ portfolios at the end of June. There were 21 hedge funds in our database with EPAM holdings at the end of the previous quarter. Our calculations also showed that EPAM isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the recent hedge fund action surrounding EPAM Systems Inc (NYSE:EPAM).

How have hedgies been trading EPAM Systems Inc (NYSE:EPAM)?

At Q2’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EPAM over the last 16 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of EPAM Systems Inc (NYSE:EPAM), with a stake worth $90 million reported as of the end of March. Trailing AQR Capital Management was Marshall Wace LLP, which amassed a stake valued at $83.6 million. Renaissance Technologies, Arrowstreet Capital, and Adage Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most outsized position in EPAM Systems Inc (NYSE:EPAM). Marshall Wace LLP had $83.6 million invested in the company at the end of the quarter. Renaissance Technologies also initiated a $22.7 million position during the quarter. The other funds with brand new EPAM positions are Ken Griffin’s Citadel Investment Group, Steve Cohen’s Point72 Asset Management, and Jonathan Lourie and Stuart Fiertz’s Cheyne Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as EPAM Systems Inc (NYSE:EPAM) but similarly valued. These stocks are WestRock Company (NYSE:WRK), 58.com Inc (NYSE:WUBA), Huntington Ingalls Industries Inc (NYSE:HII), and Federal Realty Investment Trust (NYSE:FRT). This group of stocks’ market caps match EPAM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRK | 26 | 428562 | 3 |

| WUBA | 22 | 434944 | -2 |

| HII | 23 | 668970 | -8 |

| FRT | 23 | 222584 | 6 |

| Average | 23.5 | 438765 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $439 million. That figure was $261 million in EPAM’s case. WestRock Company (NYSE:WRK) is the most popular stock in this table. On the other hand 58.com Inc (NYSE:WUBA) is the least popular one with only 22 bullish hedge fund positions. EPAM Systems Inc (NYSE:EPAM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on EPAM, though not to the same extent, as the stock returned 5.3% during the third quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.